Registration under Start-up India Scheme

Why Choose Dastawezz ?

INTRODUCTION

Startup India Scheme is a policy by Indian government launched in 2016 whose main objective is to promote startups, help in generating employment and in creation of wealth. Under it several programs have been initiated for creating a robust ecosystem of startups so as to convert India from a majority of job seekers to job creators. It is regulated under the Department for Industrial Policy and Promotion (DPIIT).

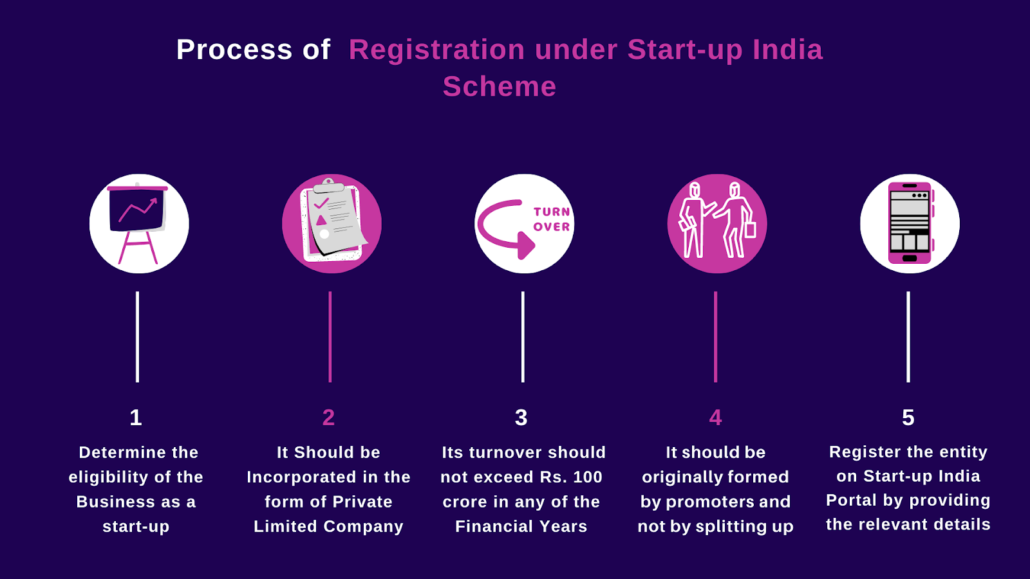

PROCESS

1. First, one has to determine the eligibility of the business as a startup. The requirements are that date of incorporation should be less than 10 years, it should be incorporated in the form of a private limited company, registered partnership firm or a limited liability partnership, its turnover should not exceed Rs. 100 crore in any of the financial years, it should be originally formed by promoters and not by splitting up or restructuring and finally it should have a plan for development of a product/process/service into a business model with big potential for creating wealth

and employment.

2. If these criteria are satisfied, then one has to register the entity on Start-up India Portal by providing the relevant details.

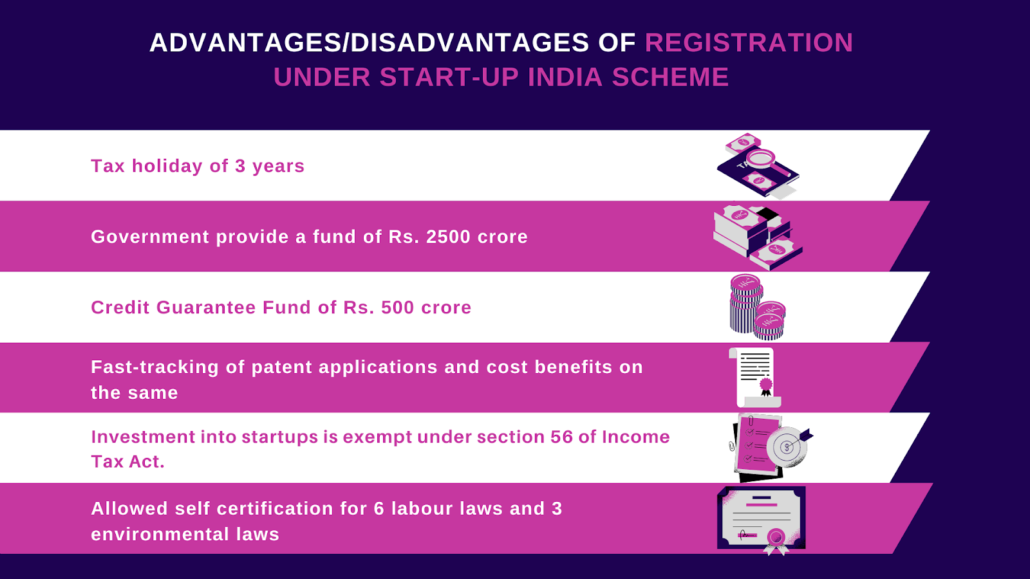

ADVANTAGES / FEATURES

- Tax holiday of 3 years.

- Government provided a fund of Rs. 2500 crore.

- Credit Guarantee Fund of Rs. 500 crore.

- Fast-tracking of patent applications and cost benefits on the same.

- Investment into startups is exempt under section 56 of Income Tax Act.

- They are allowed self certification for 6 labour laws and 3 environmental laws

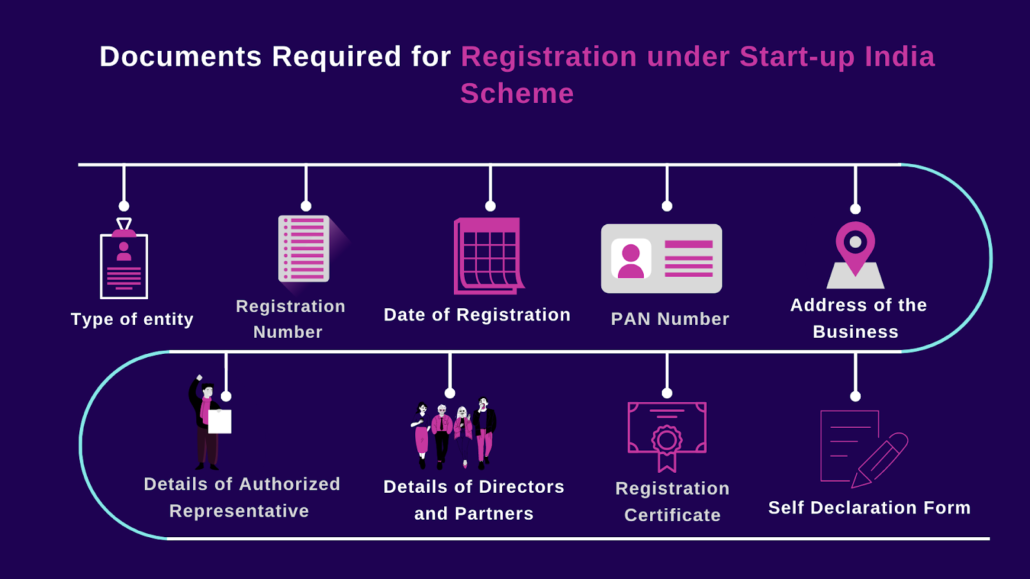

DOCUMENTS REQUIRED

- Type of entity, its incorporation or registration number, date of incorporation or registration, PAN number, address of the business, details of authorized representative, details of directors and partners, incorporation/registration certificate, self declaration form.

Users This Year : 4026

Users This Year : 4026