ESI Registration

Why Choose Dastawezz ?

INTRODUCTION

Employees State Insurance (ESI) is an autonomous, self – financing organization under the Ministry of Labour and Employment, Government of India. It is infact a social security insurance scheme for Indian workers. ESI Registration is mandatory for every factory and specified establishments who have 10 or more permanent employees with wages less than Rs. 21,000/- per month.

PROCESS

Step 1- An employer needs to get himself registered on the ESIC portal by clicking on the Sign Up button. After that, the employers need to fill in the details and submit the form.

Step 2- Upon successfully signing up and submitting the form the employer will receive a confirmation mail sent to the registered Email ID and mobile number. The confirmation mail will contain the username and password details for registering as an employer and employee under the ESIC scheme.

Step 3- Then log in to the ESIC portal with the username and password received in the confirmation mail. It will redirect to the page having the option of New Employer Registration. Click on the New Employer Registration option and then select the Type of Unit option and click on the Submit button. The Employer Registration – Form 1 (Form -1) will appear and the employer needs to fill in the details. It contains details regarding the unit of the employer, details of the employer and employees. Once, the complete form is filled by the employer, he/she needs to click on the Submit button.

Step 4- After submission of the Form-1, the Payment of Advance Contribution page will open where the employer needs to fill the respective amount to be paid and select the payment mode. The payment is required to be paid in advance contribution for 6 months.

Step 5- Upon successful completion of payment of 6 months advance contribution, the system generated Registration Letter (C-11) is sent to the employer which, contains a 17 digit Registration Number by the ESIC department. The Registration Letter is a valid proof of registration of the employer.

ADVANTAGES / FEATURES

- Medical benefits to an employee and his family members and maternity benefit to pregnant women.

- If employee dies while on work, 90% of the salary is given to his/her dependents in the form of a monthly payment after the death of the employee and same process is followed in case of disability caused to the employee while on work.

- It prrovides for funeral expenses and old age medical care expenses.

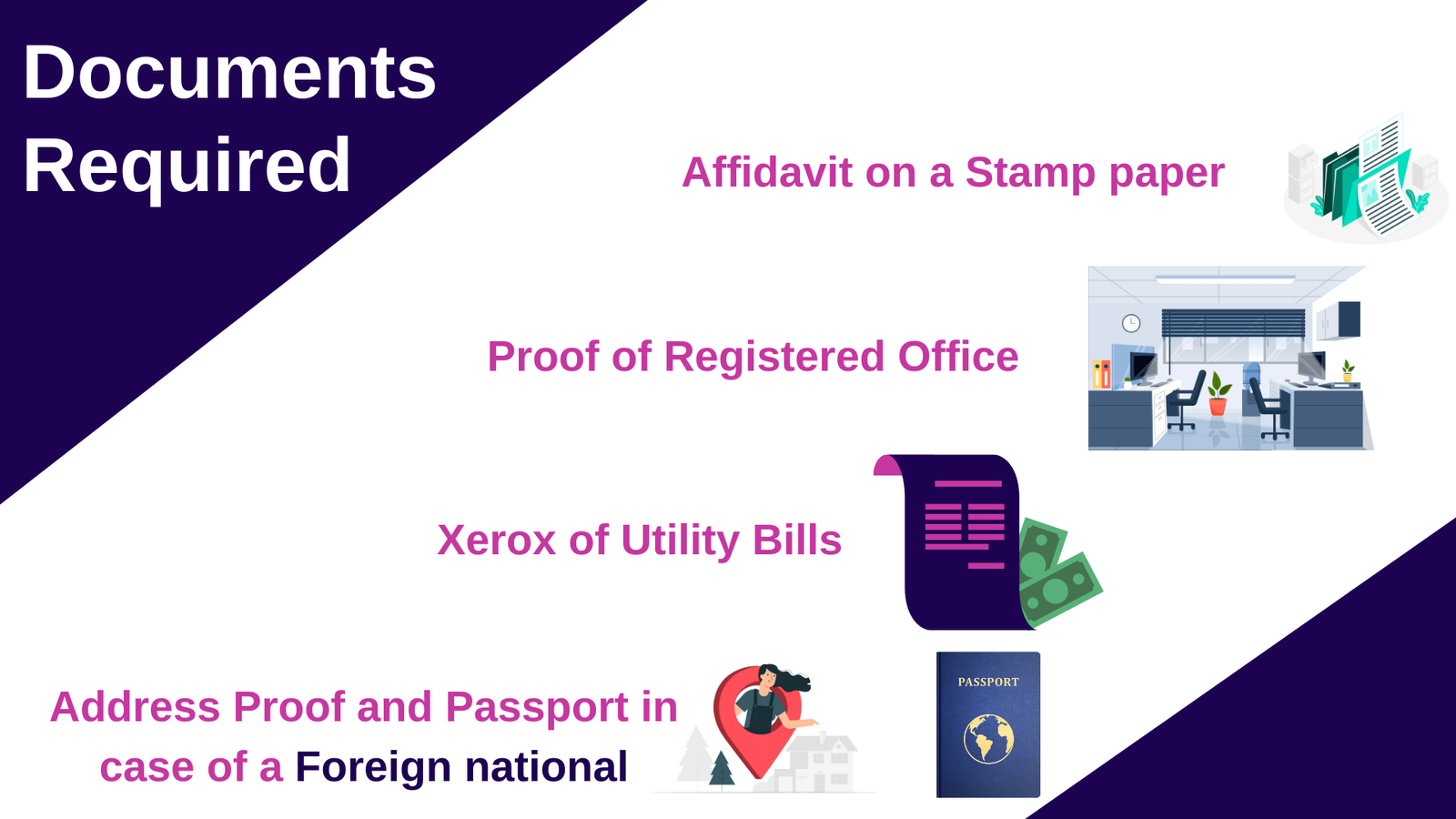

DOCUMENTS REQUIRED

- Registration certificate obtained either under the Factories Act, or Shops and Establishment Act.

- Certificate of Registration in case of Company, and Partnership deed in case of a Partnership

- Memorandum of Association and Articles of Association of the Company

- List of all the employees working in the Establishment

- PAN Card of the Business Entity and Employees.

- The compensation details of all the employees

- Cancelled cheque of the Bank Account of the Company

- List of Directors and Shareholders of the Company

- Register containing the attendance of the employees

Users This Year : 2837

Users This Year : 2837