Partnership to Private Limited Company

Why Choose Dastawezz ?

INTRODUCTION

Conversion of Partnership firm into a Private Limited Company is a good option for anyone who wishes to expand small and medium scale enterprises to a large scale one, or for infusion of equity capital.With the advent of companies amendment act 2017, the criteria of requiring minimum seven members for any entity to be converted into a Private Limited Company has been done with. Under the amended section 366 of the companies Act, 2013 any entity be it a LLP, partnership firm, co-operative society or any other business entity formed under any other law, with minimum two members can be registered as a Private Limited Company. Such conversion to take place is to be satisfied with other requirements such as securing approval from all partners and secured creditors for such conversion, a notice in newspaper to be issued in one English and one vernacular language seeking objections and finally followed by the incorporation process of Private Limited Company.The alternate option available to the partners is to set up a separate Private Limited Company and then get the entire business of Partnership Firm transferred to the company through a written agreement under which the above-mentioned requirements such as requirement for having minimum two partners, newspaper advertisement, etc. are not required to be satisfied but may attract stamp duty on transfer of property through takeover agreement and may vary in different states.

PROCESS

1. Hold a meeting of the members

Hold a meeting of all the partners of Partnership Firm and take assent for the conversion from its partners. Since the liability of the members of the firm is unlimited, when a firm desires to register itself as a company as a limited company, the assent of the majority is required, not less than three-forth of the partners should be present in person.

2. Consent from secured creditors of firm

Also Written consent or No Objection Certificate is to be obtained from the secured creditors of the firm, if any.

3. Obtaining the Name Approval in RUN for Proposed Company

An application needs to be filed with the Registrar of Companies (ROC) to obtain the name for the proposed company after conversion, with various attachments stating the fact that the partnership firm is proposed to be converted under the Companies Act, 2013.

4. Publishing the Advertisement in Two Newspaper (English Daily and Vernacular)

Pursuant to clause (b) of section 374 of the Act, firm seeking registration under the provision of Part I of Chapter XXI shall publish an advertisement about registration under the said Part, seeking objections, if any within twenty one (21) clear days from the date of publication of notice and the said advertisement shall be in Form No. URC. 2, which shall be published in a newspaper, in English and in the principal vernacular language of the district in which office of such firm situated and should be circulated in that district.

5. Affidavit

File an affidavit, duly notarised, from all the partners to provide that in the event of registration, necessary documents or papers shall be submitted to authority with which the firm was earlier registered, for its dissolution as partnership firm consequent to its conversion into private limited company.

6. Filing of necessary forms with ROC

Filing of necessary forms with ROC for the approval of conversion and for registration of firm into the Private Limited Company alongwith all the necessary attachments which specifies the fact of conversion and also all the other basis charter documents like MOA, AOA, etc which are required in case of registration of company under the Companies Act, 2013

ADVANTAGES / FEATURES

- All the assets and liabilities of the Partnership firm immediately before the conversion become the assets and liabilities of the company.

- No Capital Gains tax shall be charged on transfer of property from Partnership firm to Company.

- There are minimum two or more Partners in the existing Partnership firm for converting the Partnership firm into a Private Limited Company.

- The goodwill of the Partnership firm and its brand value is kept intact and continues to enjoy the previous success story with a better legal recognition.

- The accumulated loss and unabsorbed depreciation of Partnership firm is deemed to be loss/ depreciation of the successor company for the previous year in which conversion was effected. Thus such loss can be carried for further eight years in the hands of the successor company.

- All movable and immovable properties of the Partnership firm automatically vest in the Company. No instrument of transfer is required to be executed and hence no stamp duty is required to be paid.

- All partners of the partnership firm shall become shareholders of the company in the same proportion in which their capital accounts stood in the books of the firm on the date of the conversion.

- The partners receive consideration only by way of allotment of shares in company and the partners share holding in the company in aggregate is 50% or more of its total voting power.

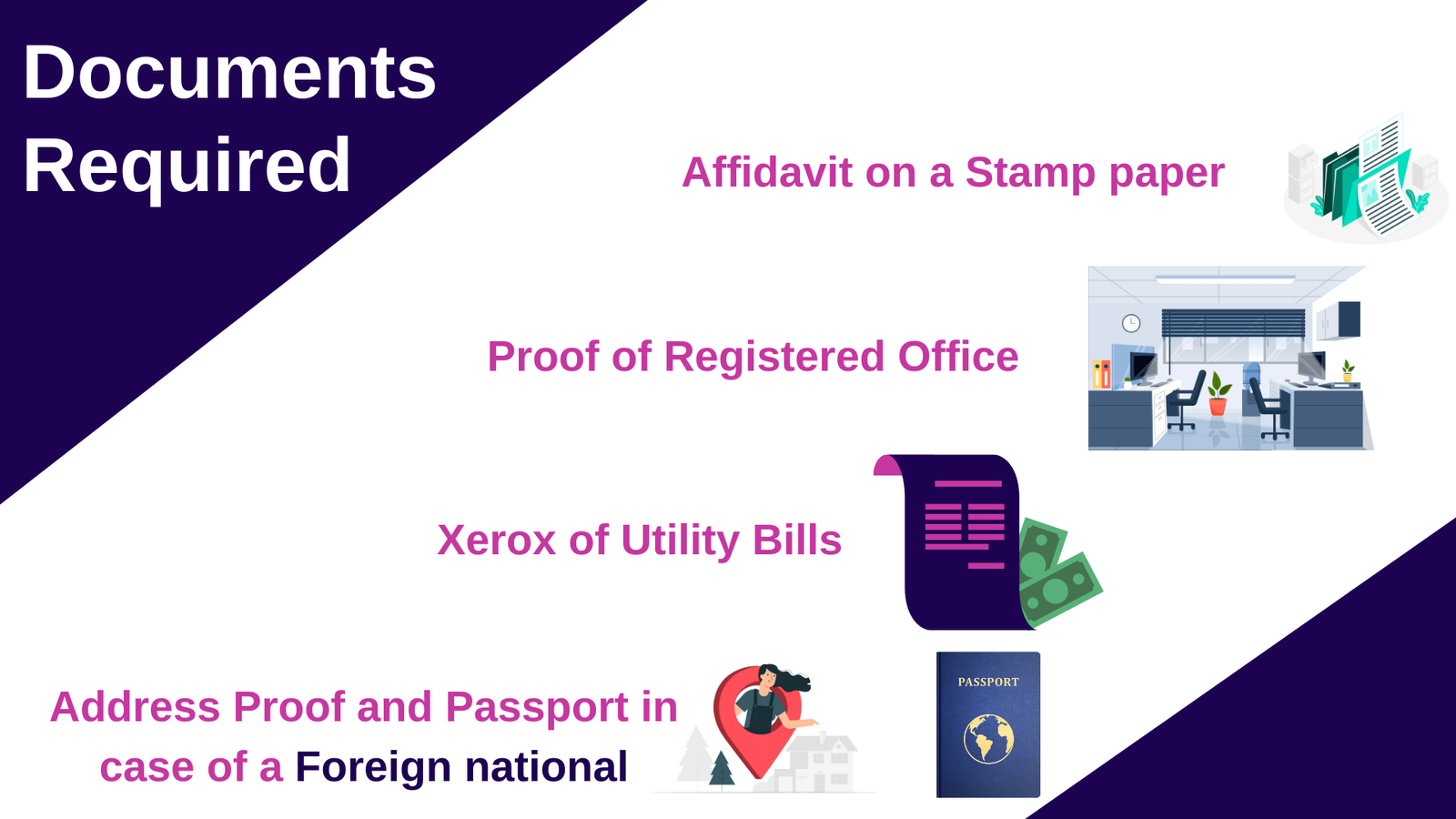

DOCUMENTS REQUIRED

a) Registered Partnership firm with minimum 2 or more Partners

b) Minimum Share Capital shall be Rs. 100,000 (INR One Lac) for conversion into a Private Limited Company

c) There must be provision in the Partnership deed for converting the firm into Company

d) There must be an agreement between the partners to convert the firm into Company.

d) If the above requirement is not fulfilled by the firm, then the Partnership deed should be altered

e) Minimum 2 Shareholders and Directors. However, Directors and shareholders can be same person.

h) Director Identification Number (DIN) for all the Directors.

i) Digital Signature Certificate (DSC) for two of the Directors.

Users This Year : 13204

Users This Year : 13204