Change in share capital

Why Choose Dastawezz ?

INTRODUCTION

When a company is in the early stages of incorporation, one of the most important decisions that supporters must make is the amount of capital to invest in the company. As the business grows, the Company may consider expanding its operations, whether in size, scale, or structure. To make that dream a reality, more funds may need to be invested in the company, essentially changing the share capital of the Company. The authorised capital is the maximum amount of capital for which the corporation can issue shares to shareholders. The Authorised Capital limit is specified in the Memorandum of Association under the Capital Clause, as per Section 2(8) of the Companies Act, 2013. A company may take the following necessary steps to increase or change the authorised capital limit in order to issue more shares:

1.Authorization In Articles Of Association

The Articles of Association of the company must provide the power to increase the authorized capital of the company if not then alter the article of the company by passing a special resolution in the general meeting of the company.

2.Conduct a Board Meeting:

Call and convene the board meeting of the company and decide the way to issue new shares either to the existing shareholder or other than the existing shareholder and pass the board resolution for the same.

3.Issue Notice and Conduct General Meeting:

Issue notice to the members of the company as per Section 101 of the Companies Act, 2013 for calling a general meeting and to approve the same by passing members’ resolution. Submit the relevant form to the MCA as required.

4.Approval of ROC

File with the Registrar within thirty days of passing of the resolution with the required documents evidencing the change in the authorised share capital of the company.

5.Incorporate Changes

Incorporate changes in the capital clause in all the copies of the memorandum and articles of association of the company lying at the registered office of the company.

6.Issue and allot shares to the shareholders of the company within 60 days of depositing the application amount.

7.After allotment of shares issued, the company shall issue share certificates to the shareholders of the company respective of their shares within two months of allotment of shares.

PROCESS

ADVANTAGES / FEATURES

- With an increase in cash derived from the sale of shares, the company may grow its business without having to borrow from traditional sources.

- With more cash in the company offers, additional compensation may be offered to investors, stakeholders, founders and owners, partners, senior management and employees enrolled in stock ownership plans.

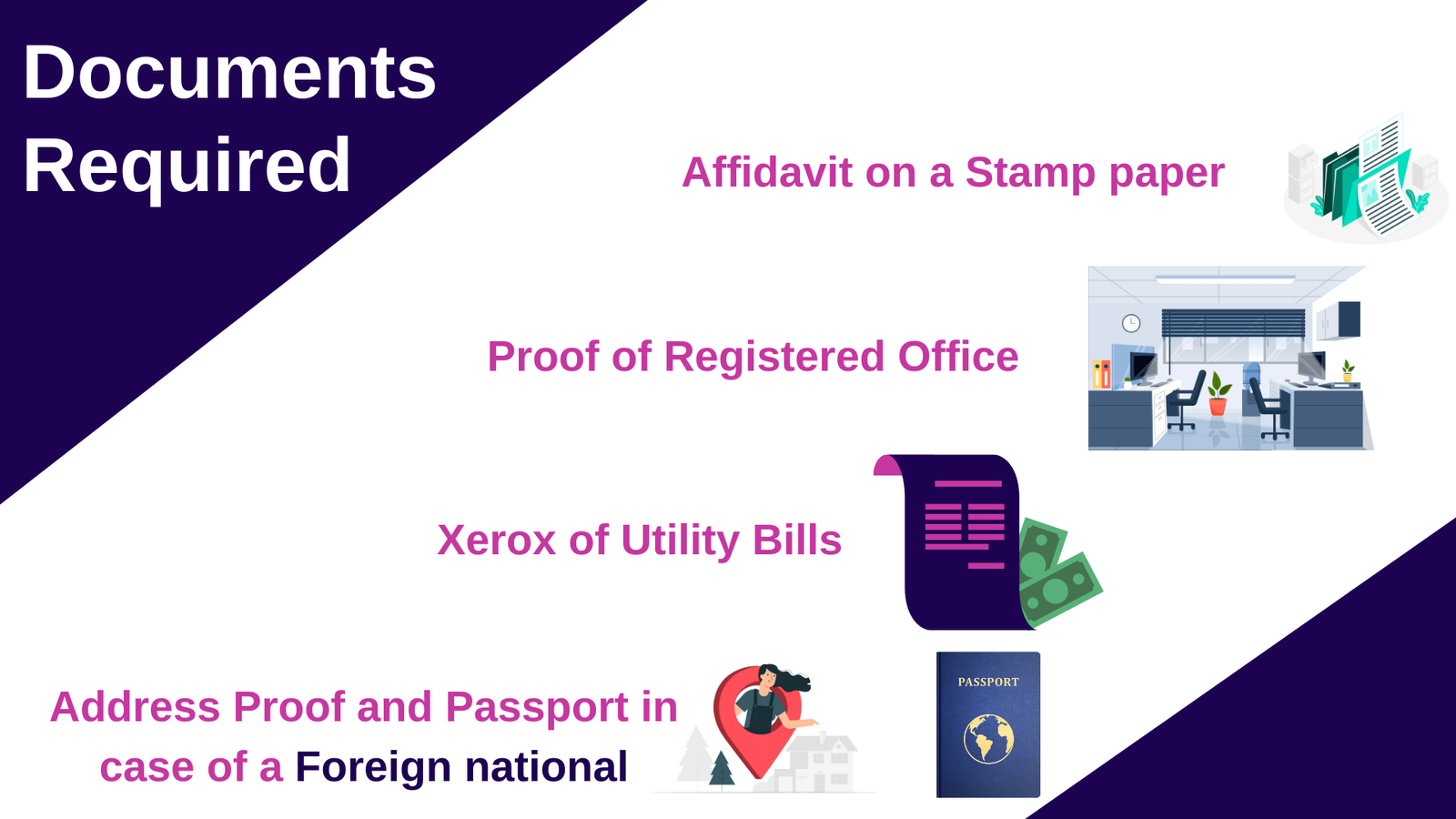

DOCUMENTS REQUIRED

- Announcement of General Meeting and modified Memorandum of Association (MOA) and Articles of Association (AOA).

- A valid certified copy of Board resolution for alteration in MOA and AOA and copy of Shareholders resolution.

- Duplicates of audited balance sheets for the past three years

- Resolution for permitting such consolidation or division and providing an explanation for the equivalent.

- Credentials in proof of new capital arrangement and class of shares presented consolidated or divided.

- Affidavit authenticating the petition and bank draft substantiating payment of request fee.

Users This Year : 2110

Users This Year : 2110