Complaint for cheque Bounce

Why Choose Dastawezz ?

INTRODUCTION

A cheque bounce is when an unpaid cheque is returned back by the bank, also known as dishonour of cheque. Cheque bounce can eventuate because of a lot of reasons, for instance, due to insufficiency of funds in the account of the ‘drawer’ and many other reasons.The bank always issues a cheque return memo with the necessary reasons for non- payment as soon as the cheque gets bounced. In India. a cheque bounce is a criminal offence stipulated under Section- 138 of the Negotiable Instruments Act, 1881. However, in case of a cheque bounce, the aggrieved party can file a criminal as well as a civil suit against the accused.

PROCESS

- Demand Legal Notice:According to Section 138 of the Negotiable Instruments Act, the payee must send a formal notice to the drawer after the cheque gets bounced. Ensure to send the notice to the defaulter within 15 days of dishonour of notice.

- Draft Important Details in the Notice: The legalnotice must be drafted carefully without committing any mistakes. The best practice is to appoint a lawyer and provide him with all the details. The legal notice must consists of all the facts regarding payee like the amount of Loan, the nature of the transaction, Date of deposit in Bank, Date of dishonour of cheque, etc.

- Law provides Grace Period to the Drawer: The Drawer gets 15 days grace period to pay off his debtto the payee as per the notice and an additional 15 days grace period is given according to the law to give a second chance before taking any further legal action.

- If Drawer does not pay the debt within 15 days:When a person denies paying the rightful debt for having insufficient funds in his account, in this case, the payee has the right to file a complaint in the form of a Criminal Case.

- The payee has 30 days period to file the Criminal Case: As per the law, the complainant has 30 daysto file the case from the expiry of the 15 Notice Period that was given to the Drawer to repay the debt.

- The court proceeds to issue the process:After you file a cheque bounce case, the court soon registers the case. The Magistrate listens to the arguments of the complainant and then issues the required process.

- Police initiate the process issued by the court: The nearby police station of the accused’s residence informs him about the case and he has to comply by serving the summons at his residence.

- The court may also issue a Warrant: Lastly, in some of the cheque bounce cases, the accused remains absent on the Court Dates even after service of the summons. It compels the court to issue a warrant against him.

ADVANTAGES / FEATURES

- It helps to initiate criminal or civil proceedings against a party who has defaulted you.

- It helps to recover money which would have otherwise been lost, from the defaulting party.

- After the whole trial process, If found guilty, the accused can be punished with a monetary penalty which may be double of the amount of cheque or imprisonment up to 2 years or both.

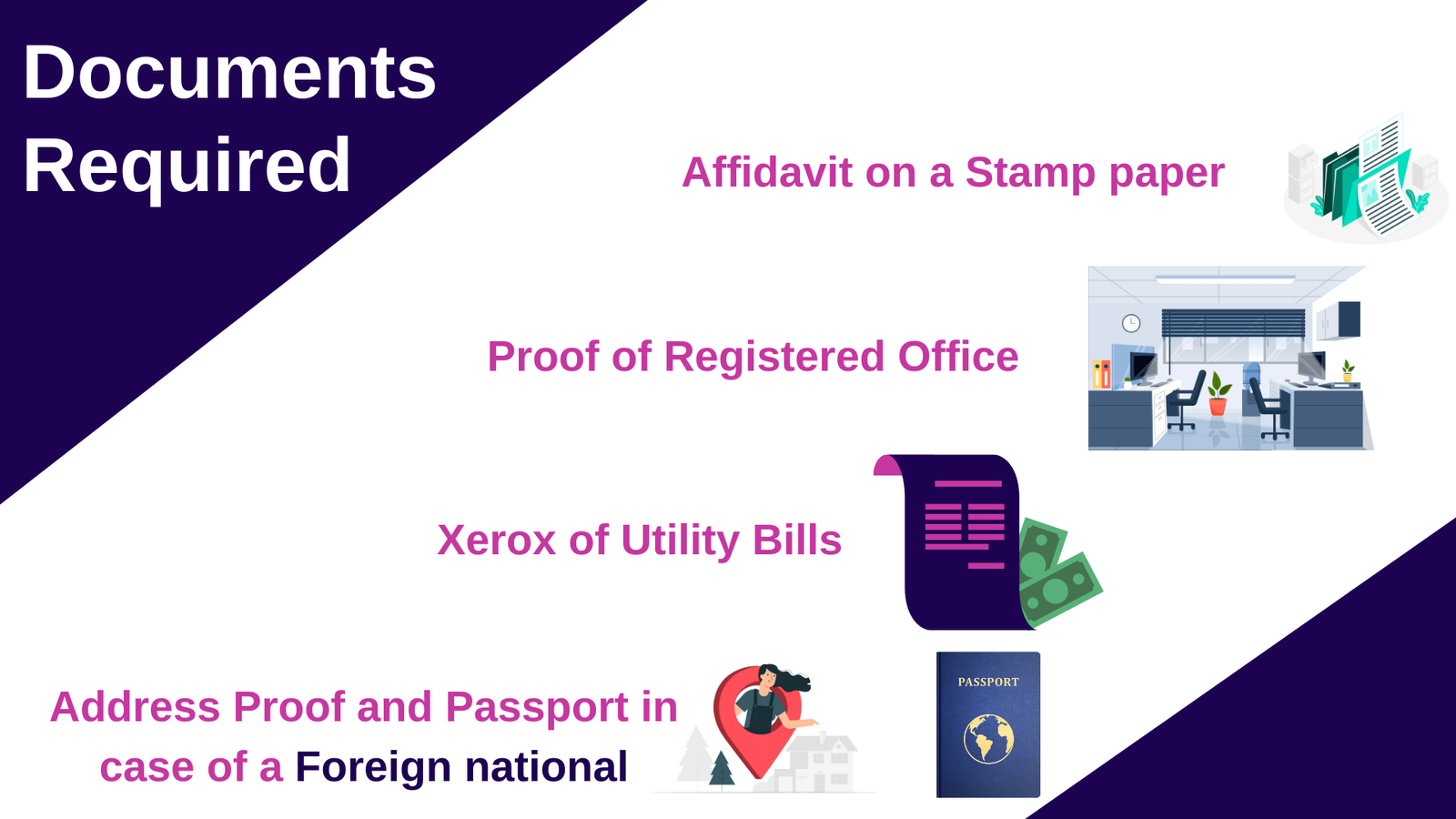

DOCUMENTS REQUIRED

- Original Cheque

- Photocopies of the cheque returned by the bank, memo.

- Copy of the legal notice for demand sent to the drawer and the acknowledgment slips/ receipts

- Original Postal Receipt and Copy of Acknowledgement of due service

- Proof of lawful debt or liability

- Authorisation letter / Power of Attorney

- Written complaint

- An affidavit in support of the compliant verifying its particulars

- An Evidence Affidavit under Section 200 of Code of Criminal Procedure of complainant.

- Letter of oath

Users This Year : 12646

Users This Year : 12646