Director Identification Number

Why Choose Dastawezz ?

INTRODUCTION

A Director Identification Number is a unique identification number allotted to a director of a company, after an application made to the Ministry of Corporate Affairs, pursuant to Section 153 and 154, of the Companies Act, 2013.

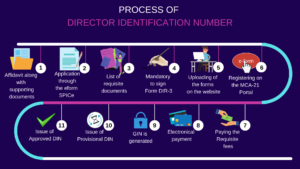

PROCESS

An application for allotment of Director Identification Number, as per Section 153 and Rule 9 can be made as under:

- Every individual who is to be appointed as a director of a company, has to make an application, electronically, by filing forms DIR-3 (Application for allotment of Director Identification Number) and DIR-4 (Verification of applicant for application for DIN), which has to be filed in the form of an affidavit, along with supporting documents.

- Individuals who, by virtue of Section 152 of the Act, are signatories to the memorandum and become directors are required to make an application through eform

- The forms as well as a list of requisite documents, can be found below.

- It is mandatory for the applicant to sign Form DIR-3, using his/her Digital Signature Certificate (DSC), and the form has to be verified, digitally, by any of the following:

- A company secretary, in full time employment of the company

- The Managing director

- Director

- Chief Financial Officer (CFO)

- Chief Economic Officer (CEO)

Of the company, the applicant is seeking appointment.

- The forms have to be uploaded on the website of Ministry of Corporate Affairs.

- In order to upload the forms, the user has to register himself/herself on the MCA21 portal and upon obtaining the login details, the forms can be uploaded by clicking on “eforms” tab.

- Upon upload, the applicant has to pay the requisite fee, i.e. INR 500/-

- The payment can only be made electronically, i.e. via Net Banking, NeFT, Credit Card or Debit Card. However, there is an option for deferred payment.

- After submission, the forms and documents are scrutinized and a GIN is generated, upon approval.

- If the application made by the applicant is identified as a potential duplicate, then a provisional DIN is generated and if there is no such identification, the applicant is issued with an Approved DIN.

- The above application, identified as potentially duplicate, is sent to the DIN cell for processing and upon approval of the form, the provisional DIN becomes approved DIN.

As per Section 155 of the Act no individual shall obtain more than one DIN.

Section 156 of the Act makes it mandatory for every director, to inform Company/Companies where he is a director, about the receipt of his Director Identification Number, within one month of such receipt and the Company/Companies have to inform the Registrar of Companies (ROC), within fifteen days of such intimidation, as per Section 157.

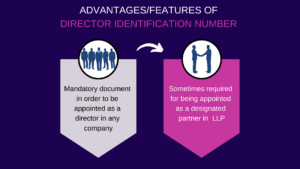

ADVANTAGES / FEATURES

- It is a mandatory document in order to be appointed as a director in any company

- It is also sometimes required for being appointed as a designated partner in an LLP

DOCUMENTS REQUIRED

- High resolution photograph

- Income tax issued; Permanent Account Number (PAN) is mandatory in case of Indiannational.

- Attested copy of passport is mandatory as an identity proof in the case of foreign nationals.

- Duly attested present Address proof (not older than 2 months)

Users This Year : 3958

Users This Year : 3958