GST REGISTRATION FOR FOREIGN NATIONAL

Any foreign person or foreign business or organization supplying the goods or services to India would be a non-resident taxable person is required to comply the GST regulations in India.

GST REGISTRATION

All non-resident taxable persons are required to obtain the GST registration in India, irrespective of aggregate annual turnover or any other criteria. Further, the GST Act and Rules specify that all non-resident taxable persons must obtain GST registration five days prior to the commencement of business. Hence, it is important for foreign businesses supplying goods and services to India to obtain GST Registration at the earliest.

Procedure for Applying the GST Registration

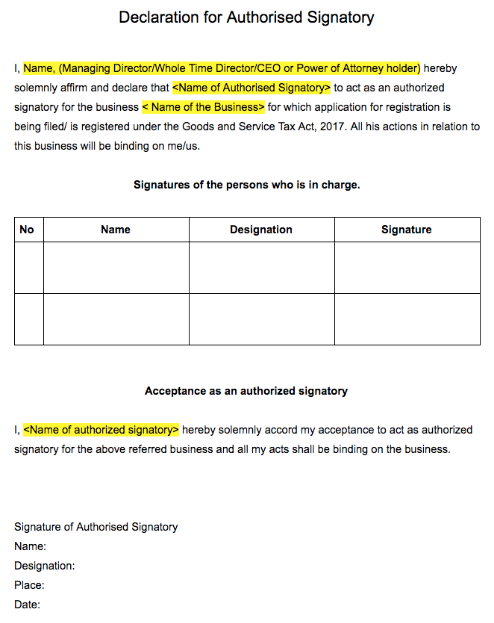

Prior to beginning the process for applying the GST registration, foreign businesses or foreign applicants must identify a person in India to act as its authorized representative for GST compliance and obtain PAN in India for the foreign national . As per GST rules, the application for GST registration made by a non-resident taxable person should be signed by his authorized signatory who shall be a person resident in India having a valid PAN.

Apply the GST registration as a non-resident taxable person, the application must be submitted in FORM GST REG-09. GST registration is PAN based for regular taxpayers. Moreover, in the case of non-resident taxable persons, the GST registration application can be submitted with a tax identification number or unique number on the basis of which the entity is identified by the Government of that country or its PAN, if available.

GST Registration Procedure – OIDAR Service Providers

In case of a non-resident taxable person supplying online information and database access or retrieval (OIDAR) services to a non-taxable online recipient, then application in FORM GST REG-10 must be submitted electronically.

DOCUMENTS REQUIRED FOR GST REGISTRATION

The following documents must be provided by the non-resident taxable person during the GST registration process:

- The document of the ownership of the premises like Latest Property Tax Receipt or Electricity Bill.

- Lease Agreement of the premises of the Lesser .

- A copy of the Consent Letter from the premises owners

Identity Proof

- Scanned copy of the passport of the Non -resident taxable person with Indian valid VISA . In case of a business entity incorporated or established outside India, the application for registration shall be submitted along with its tax identification number or unique number on the basis of which the entity is identified by the Government of that country .

- In case of Company/Society/LLP/FCNR/ etc. person who is holding power of attorney with an authorization letter.

- Scanned copy of Certificate of Incorporation, if the Company is registered outside India or in India.

- Scanned copy of License is issued by the foreign country

- Scanned copy of Clearance certificate issued by Government of India

Bank Account Proof

- Scanned copy of the Bank passbook with photo ID

GST DEPOSIT FOR NON-RESIDENT TAXABLE PERSONS

Non-resident taxable persons under the GST norms can pay the tax liability in advance based on the approximated tax liability within a extension period.

Once, the GST registration process done by the application and on the basis of reference number will be generated for payment of advance tax. Once you paid the taxes then it will reflect in the electronic cash ledger accounts .

VALIDITY OF GST REGISTRATION FOR NON-RESIDENT TAXABLE PERSONS

GST registration for casual taxable persons and non-resident taxable persons are provided with a validity period. The validity period would be based on the request of the taxable person , and the amount of GST deposit remitted. If a non-resident taxable person intends to extend the validity period of GST registration, an application can be made in FORM GST REG-11 before the end of the validity of the registration.

IMPORTANT INSTRUCTIONS FOR NON-RESIDENT TAXPAYERS

- Name of Applicant must be entered as per the passport.

- It is mandatory for the applicant to apply the GST registration on portal at least five days before from the commencement of their business.

- Tax identification number / PAN (if applicable) is necessary to be submitted along with the application form , in case of a business entity incorporated or

established outside India.

- The applicant must be duly signed and verified through EVC.

In case of NRI, in order to obtain the GST registration to be followed :

- Provisional registration

- Final registration

PROVISIONAL REGISTRATION

An application in Form GST REG-09 is required to be submitted, electronically, by the Non-resident taxable person (NRI). Self-attached copy of valid passport is to be submitted along with the application.

Further, in the case of foreign entity, application for GST registration is to be submitted along with tax identification number or unique number or PAN (if applicable).

A non-resident taxable person is required to deposit the advance tax. Such advance payment of tax would be based on self-estimation. Advance tax deposit is mandatory to be submitted along with the application.

FINAL REGISTRATION

Final registration of Non-resident taxable person would be carried out in the same line as of the resident taxpayer in India. The procedure for the same is narrated as below :

The applicant is required to submit by electronically with application FORM GST REG-26 . The applicant is required to submit all the information related to tax and GST within three months from the provisional registration.

If the information provided is accurate and complete, then, final GST registration will be issued to the applicant in FORM GST REG-06. Moreover, if the information provided is incorrect or incomplete, the officer would issue a show-cause notice to the applicant in FORM GST REG-27.

If the applicant is not able to give an appropriate reply to the department then might be the provisional registration would be cancelled through FORM GST REG-28.

Users This Year : 12646

Users This Year : 12646