Import & Export Code (“IEC”) Registration

Why Choose Dastawezz ?

INTRODUCTION

An ‘IEC license’ or ‘Importer Exporter Code’ is required for businesses who seek to engage in importing or exporting goods from or into India respectively. It is issued by the Director General of Foreign Trade (“DGFT”) containing a 10 digit code with lifetime validity. One can neither import goods without it nor can one avail benefits under the Export scheme without it.

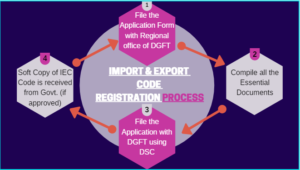

PROCESS

- First an application form is to be prepared in specified format and filed with the regional office of DGFT.

- Second, all the essential documents need to be compiled.

- Third, after the application is complete it is required to be filed with DGFT using a DSC.

- Fourth, if the application is approved, a soft copy of IEC Code is received from the government.

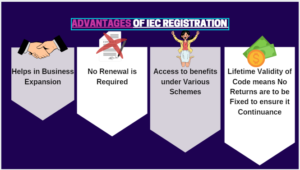

ADVANTAGES / FEATURES

- It helps in business expansion by allowing import/export.

- It allows for access to benefits under various schemes.

- Lifetime validity of code means no returns are to be filed to ensure its continuance

- No renewal is required.

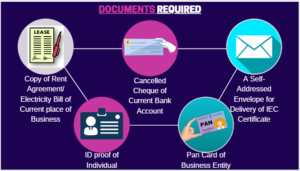

DOCUMENTS REQUIRED

PAN card of business entity, ID proof of individual, cancelled cheque of current bank account, copy of rent agreement/electricity bill of current place of business and a self-addressed envelope for delivery of IEC certificate by post.

Users This Year : 20288

Users This Year : 20288