Letter of Undertaking (“LUT”) under GST

Why Choose Dastawezz ?

INTRODUCTION

An LUT is a document which when filed by an exporter of goods allows him to export the same without having to pay any tax. Under IGST all exports are taxed which can later be refunded against the tax paid. It helps exporters since they don’t have block funds in tax and they also don’t have to go through the pain of difficulties in tax refund processing. This is allowed under the CGST Rules of 2017.

PROCESS

- The entire process is online. First, a self declaration has to be filed with an undertaking to complete export in 3 months, adhere to laws and in case of failure pay 18 % IGST.

- Then details of 2 witnesses which are independent is to be given.

- Application is then signed with a DSC or electronic verification code and submitted. The LUT can then be downloaded.

ADVANTAGES / FEATURES

- Avoids unnecessary blockage of funds.

- Avoids difficulties faced in claiming tax refund.

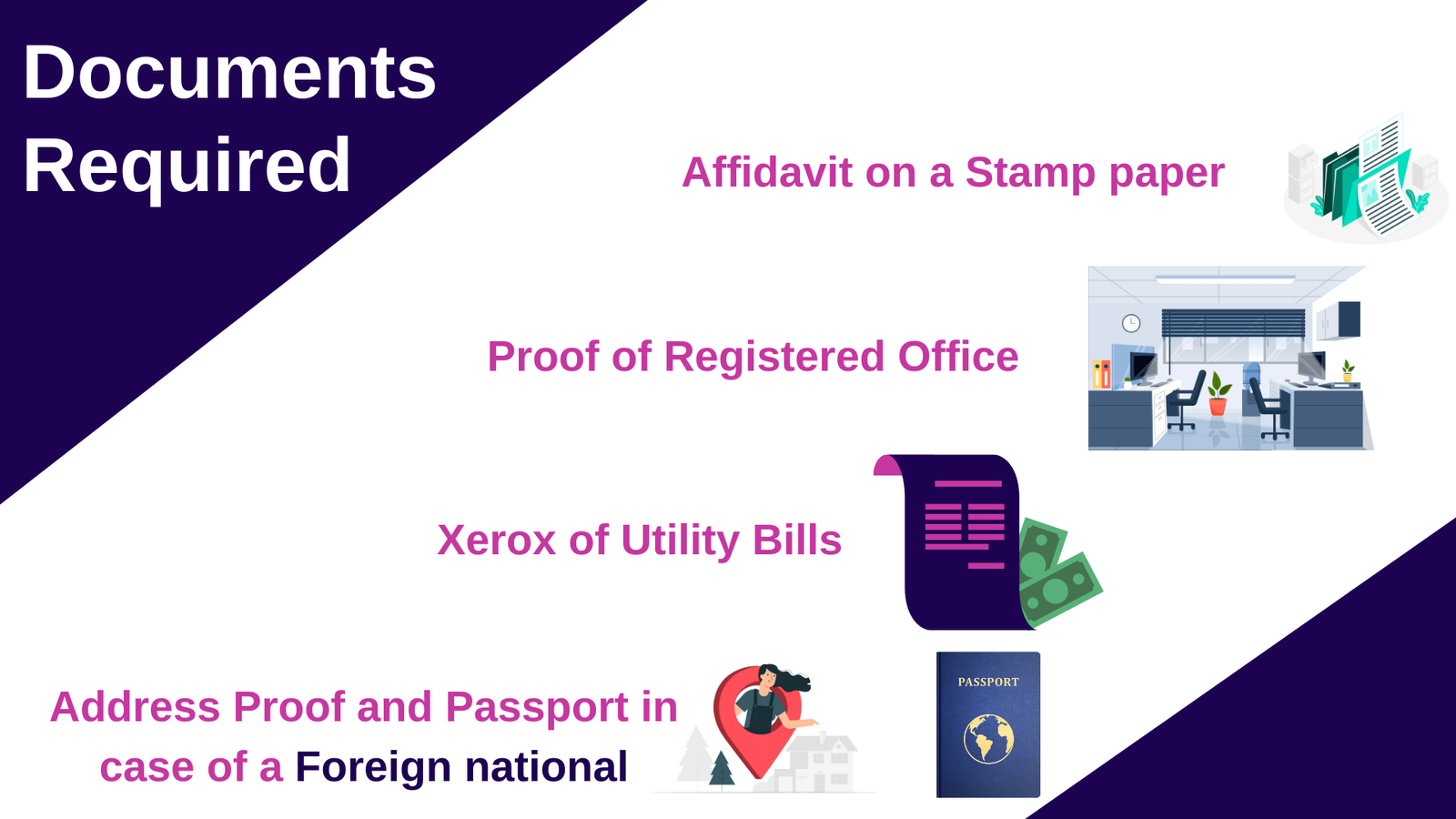

DOCUMENTS REQUIRED

A cover letter or a request for acceptance which is signed by an authorized person, duplicate of GST registration. entity’s PAN Card, KYC of authorized signatory, GST RFD 11 form, copy of IEC code, cancelled cheque, authorization letter.

Users This Year : 2110

Users This Year : 2110