Conversion of Private Limited company to Limited Liability Partnership (“LLP”)

Why Choose Dastawezz ?

INTRODUCTION

A company owned privately for businesses which are small in size is called a Private Limited Company whereas an LLP is a hybrid of a company and a partnership where each partner’s liability is limited to his/her contribution to the capital.

PROCESS

- First, as a prerequisite for conversion, every member of the company should agree to convert and become a partner of the LLP. Latest tax return is to be filed with ROC and No objection certification form creditors is to be obtained.

- Then, a board meeting is to be convened for passing of resolution for conversion and filing of the same with the Ministry for Corporate Affairs.

- Next, application for availability of name is filed and so is the incorporation form with the required documents

- Next, the application for conversion is filed with ROC and once approved, the ROC issues a certificate of incorporation for the LLP.

- As a next step, the LLP agreement is drafted and filed in the appropriate form.

ADVANTAGES / FEATURES

- It is a separate legal entity which can sue and be sued in its own name.

- There is no distinction between who owns and manages the business since partners do both unlike what happens in a company.

- Partners have flexibility in the type of agreement they want to create outlining their rights and duties.

- There is limited liability of partners only to the extent of their contribution.

- An LLP has fewer compliance requirements in comparison to a company.

- Also, an LLP is easy to wind-up in comparison to a company.

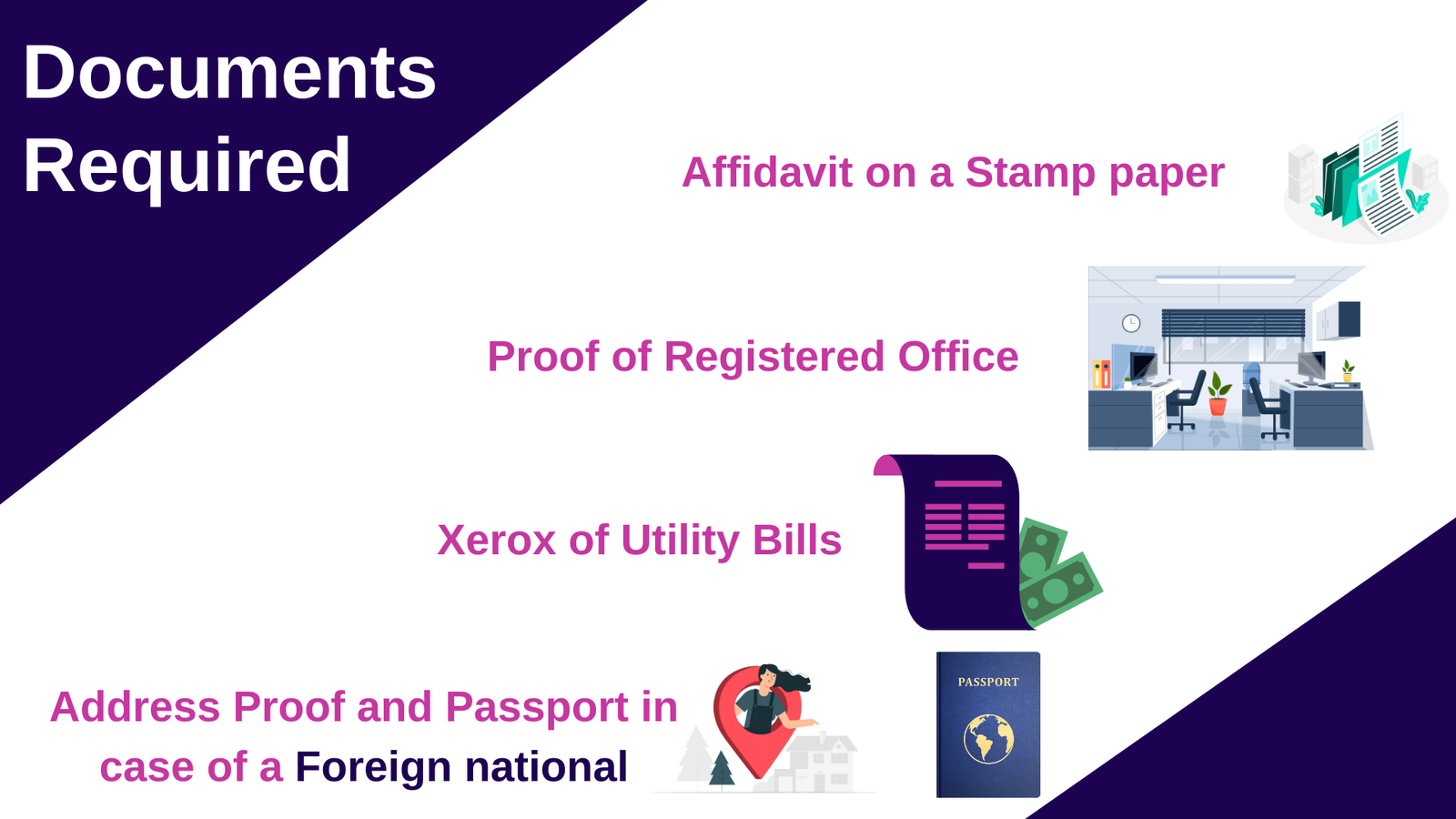

DOCUMENTS REQUIRED

Statement of consent from shareholders, NOC from creditors, audited accounts and copy of acknowledgment of latestIT return.

Users This Year : 2110

Users This Year : 2110