PAN Application

Why Choose Dastawezz ?

INTRODUCTION

Permanent Account Number (PAN) Card is a nationalized identity card, without which one will not be able to carry out any financial transaction. It is a 10 digit unique alphanumeric number which is allocated by the Indian Income Tax Department to any tax paying person, company or HUF and has a validity of a lifetime.

PROCESS

Step 1- First one must go to the NSDL (National Securities Depositaries Limited) website and fill the Form 49A available on it for the PAN Card Application

Step 2- Once the form is filled, one must read all the necessary instructions and furnish the detials.

Step 3- Then one my pay the fees of Rs. 93 for Indian Nationals and Rs. 864 for Forgeign Nationals by way of Credit/Debit, Net Banking and Demand Draft. Upon successful payment one would get the an acknowledgement slip with a number on it, which must be saved.

Step 4- After submitting of form and successful payment, one must send the supporting documents via post or courier to NSDL. Only after receiving these supporting documents shall NSDL process ones application.

ADVANTAGES / FEATURES

- Required while filing one’s Income Tax (IT) Returns.

- PAN serves as a valid Identity Proof.

- Required while opening a Bank Account.

- Helps in reducing the Tax Deductions.

- Businesses need to have a PAN Card while starting one.

- Required for opening Demat account for purchasing and trading shares.

- Required for the purchasing moveable and immoveable property.

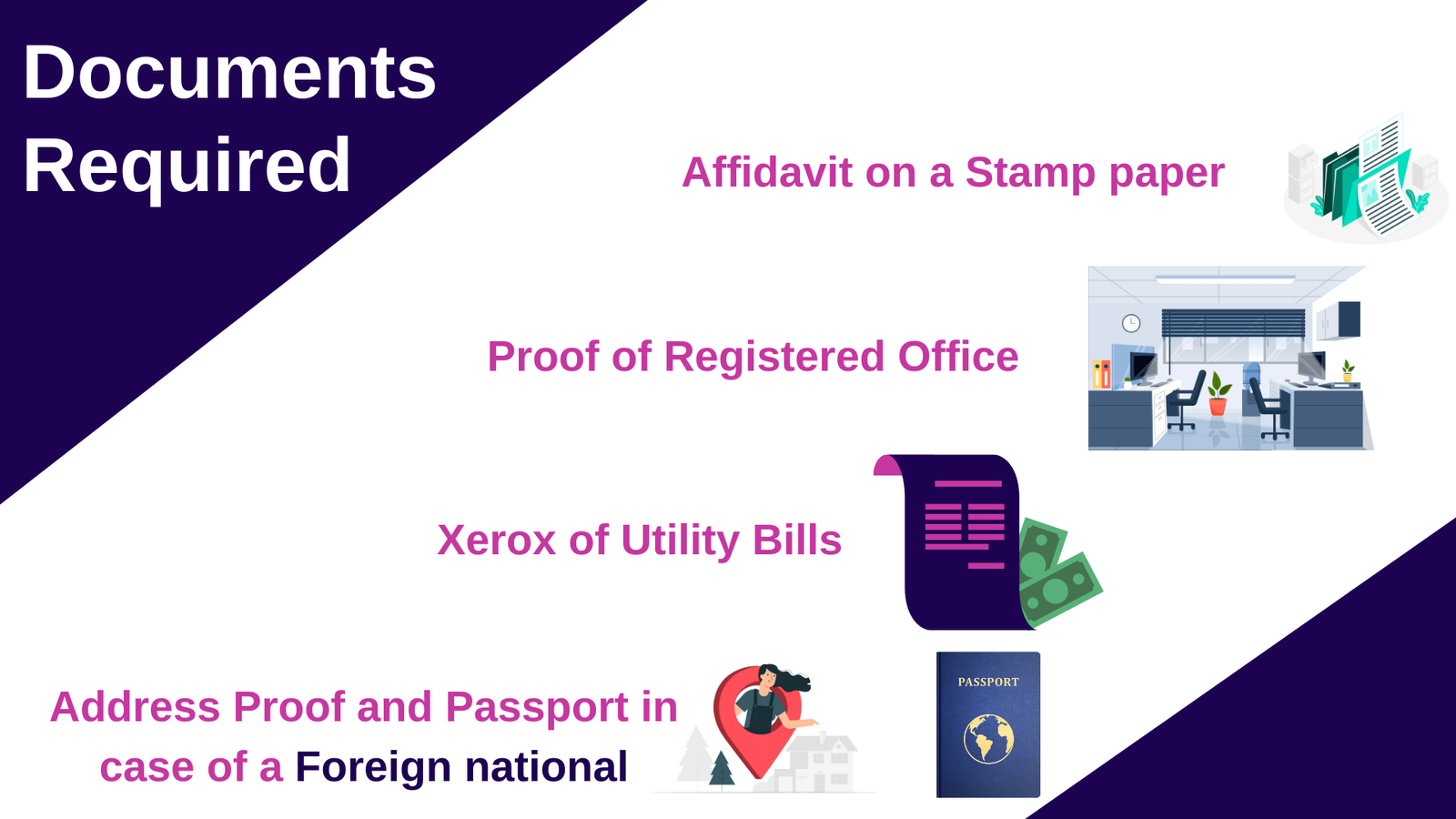

DOCUMENTS REQUIRED

- One Identity Proof (Aadhar, Passport, Driving License, Ration Card, etc.)

- One Address Proof

- One proof of Date of Birth (Aadhar, Birth Certificate, etc.)

Users This Year : 12646

Users This Year : 12646