Professional Tax Registration

Why Choose Dastawezz ?

INTRODUCTION

Professional Tax is a unique form of tax levied on individuals earning their income from any form of professions like charted accountants, lawyers, doctors etc, trade, calling, or employment. Professional Tax, unlike other taxes in India, is independently governed and regulated by state governments through the enactment of special legislations. In most of the cases, the onus of collection of professional tax is on the employer.

The maximum amount of professional tax that can be collected in India is Rs. 2500. States within these prescribed limits, impose different charges on different individuals based on their occupation and earnings.

PROCESS

The procedure for Professional Tax Registration differs from state to state. The below procedure is only applicable to the state of Maharashtra.

- Open the official website of the Maharashtra Government’s Department of Goods and Services Tax.

- Click on the ‘New Dealer Registration’ option in the ‘Other Acts Registration’ tab.

- Then click on ‘New Registration under various Acts’.

- The page will display a set of instructions and guidelines for the registration process.

- Scroll down and click on the ‘Next’ option.

- You will be directed to a new page. Click on the ‘New Dealer’ option and then click on ‘Next’, at the bottom of the page.

- Provide your Permanent Account Number (PAN) or Tax Deduction Account Number (TAN) and other particulars to create a temporary profile.

- The login credentials created above, can be used for a period of ninety days for applying for Professional Tax registration.

- Go to the home page and login using the credentials of your temporary profile.

- Post successful login, select ‘Existing User’ option and then select ‘PRTC and PETC’ in the ‘Act Selection’ page.

- After selection, user will be directed to fill the application form for Professional Tax registration.

- The Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975 and the Maharashtra State Tax on Professions, Trades, Callings and Employments Rules, 1975 made thereunder, make a distinction between the type of assesses. Section 5 of the Act distinguishes between employers and individuals who either employed by the central or state government or are employed at more than one place.

- As per Rule 3 of the 1975 Rules, employers shall register themselves for Professional Tax by making an application via Form I.

- All other individuals, liable to pay professional tax, need to register themselves with the assessing authority using Form II.

- Select either of the above two forms, as applicable and fill in the necessary particulars.

- Select the relevant option in ‘Status of the Signatory’ field and fill in the necessary details.

- The application requires the applicant to upload a digital signature to authorize and certify the information provided in the application.

- After uploading the signature and filling in the requisite details, click ‘Submit’.

- Note down the ‘Application reference Number’ which help you track the status of the application.

- A copy of your application form will also be sent to your registered email address.

- The Maharashtra State Tax Department will scrutinize the application and if satisfied, it will issue a Tax identification Number (TIN) which will be used to file all returns as well as make communication with the relevant authorities. It will also issue a Certificate of Enrolment, in the form of Form I-A or Form II-A as per Rule 3 and 4 of the Maharashtra State Tax on Professions, Trades, Callings and Employments Rules, 1975, consistent with Section 5 of the Maharashtra State Tax on Professions, Trades, Callings and Employments Act, 1975.

ADVANTAGES / FEATURES

- Professional Tax registration is mandatory

- It is not proportional to income

- It is a fixed charge levied on various income slabs

- It varies from state to state

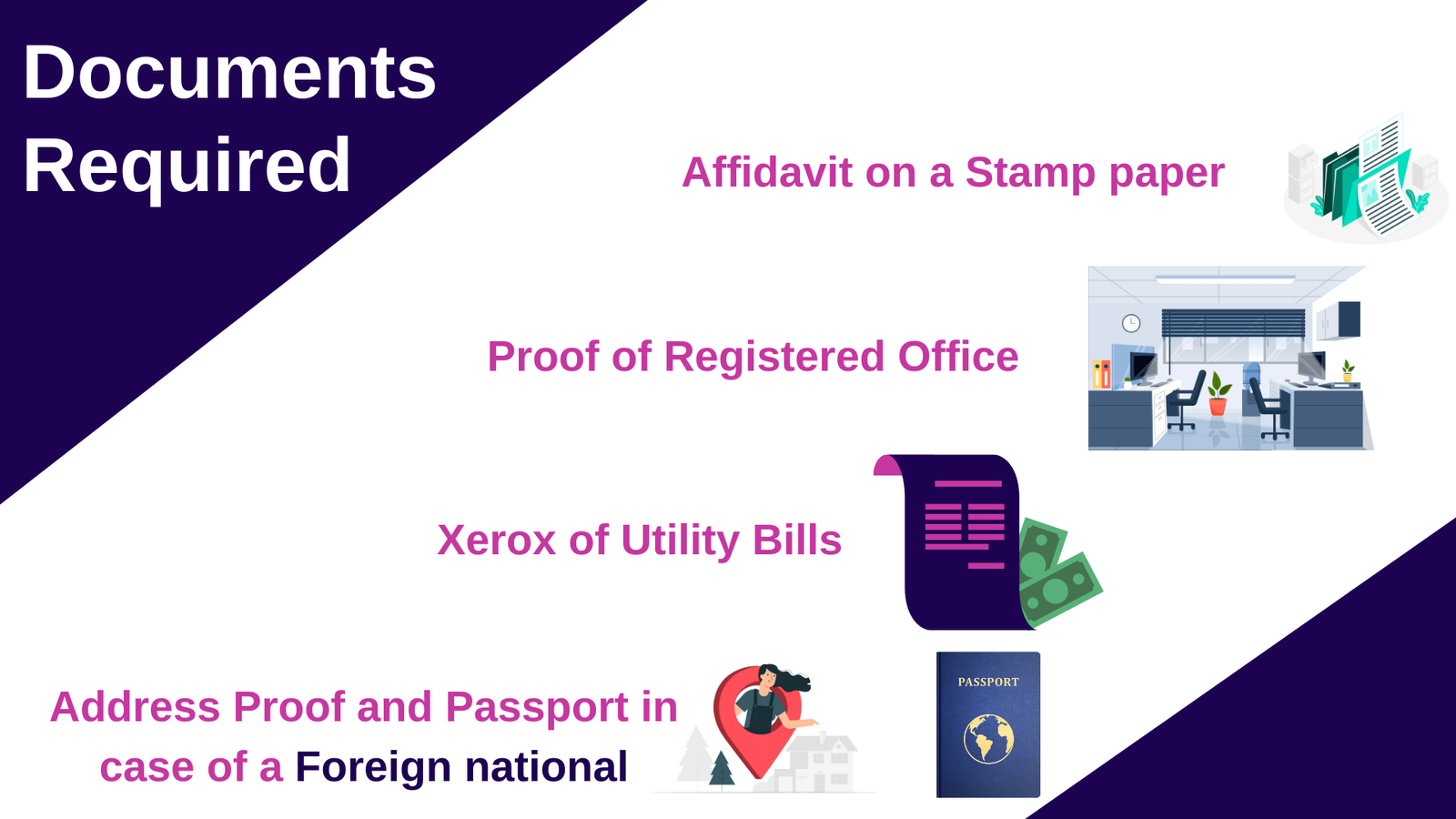

DOCUMENTS REQUIRED

- PAN and TAN

- Proof of Identification

- Proof of Address

- Proof of Income

Users This Year : 2110

Users This Year : 2110