Conversion of Proprietorship to Private Limited Company

Why Choose Dastawezz ?

INTRODUCTION

A sole proprietorship cannot get all benefits of operation as it grows. So, there will be a need to convert the proprietorship into a private limited company. The conversion can bring in its wake all the benefits of a company like higher capital, limited liability, and so on. Conversion of a proprietorship into a private limited company provides many benefits, but it also brings along the diffusion of power and loss of independence. Therefore, the decision must be taken after careful consideration of all the factors involved and see if it genuinely brings about privileges intended.

A takeover agreement or sale agreement needs to be entered into between the sole proprietor and company.

- The Memorandum of Association (MOA) needs to carry the object “The take over of a sole proprietorship”.

- All the assets and liabilities of the sole proprietorship must be transferred to the company.

- The shareholding of the proprietor should not be less than 50% of the voting power, and the same must continue to be held for a period of 5 years.

- The proprietor does not receive any additional benefits either directly or indirectly, except to the extent of shares held.

PROCESS

The following are the steps involved in the conversion of the proprietorship to the company when the requirements are met:

- The proprietor must complete the slump sale formalities.

- The Director Identification Number (DIN) and the Digital signature certificate (DSC) must be obtained for all the directors.

- The proprietor must apply for the availability of name in Form – 1.

- Prepare the MOA and AOA of the company specifying the objects and the rules of the company.

- Apply for the incorporation of the company to Ministry of Corporate Affairs (MCA).

- Submit all the relevant documents.

- Receive the Certificate of Incorporation.

- Apply for new PAN and TAN.

- Modify the bank details as per the conversion.

ADVANTAGES / FEATURES

To form a private limited company from a sole proprietorship, the procedure is to first form the private limited company and then take over the sole proprietorship through a Memorandum Of Association (MoA) and transfer all benefits and liabilities to the limited company. So, the following requirements must be taken care of before applying for a certificate of incorporation.

- Directors: For the formation of a private limited company minimum of two directors are required. One of them can be the proprietor himself, and the other can be any relative or friend.

- Director Identification Number: The directors need to have an Identification Number as a prerequisite to incorporation.

- Shareholders: The company needs to have a minimum of two shareholders, and they can be the same as the directors. The owner of the sole proprietorship needs to be one of the directors of the limited company.

- Capital: The company needs to have a minimum capital of 1 Lakh rupees.

So to summarize, it is as shown below:

Benefits of a Private Limited Company

Capital expansion: A sole proprietorship is limited to the capital of the owner, whereas the private limited company has fundraising options and can raise higher capital for expansion.

- Limited liability: A sole proprietor is wholly responsible for the losses, and his/her personal assets also get attached to repay creditors in case of losses, however, in case of a private limited company, such liabilities are limited by shares or warranty.

- Continuity: A sole proprietorship is dependent on a single person, so its existence is limited to that of the proprietor’s ability to operate. Whereas, the private limited company is a separate legal entity and not bound by the existence of a single owner.

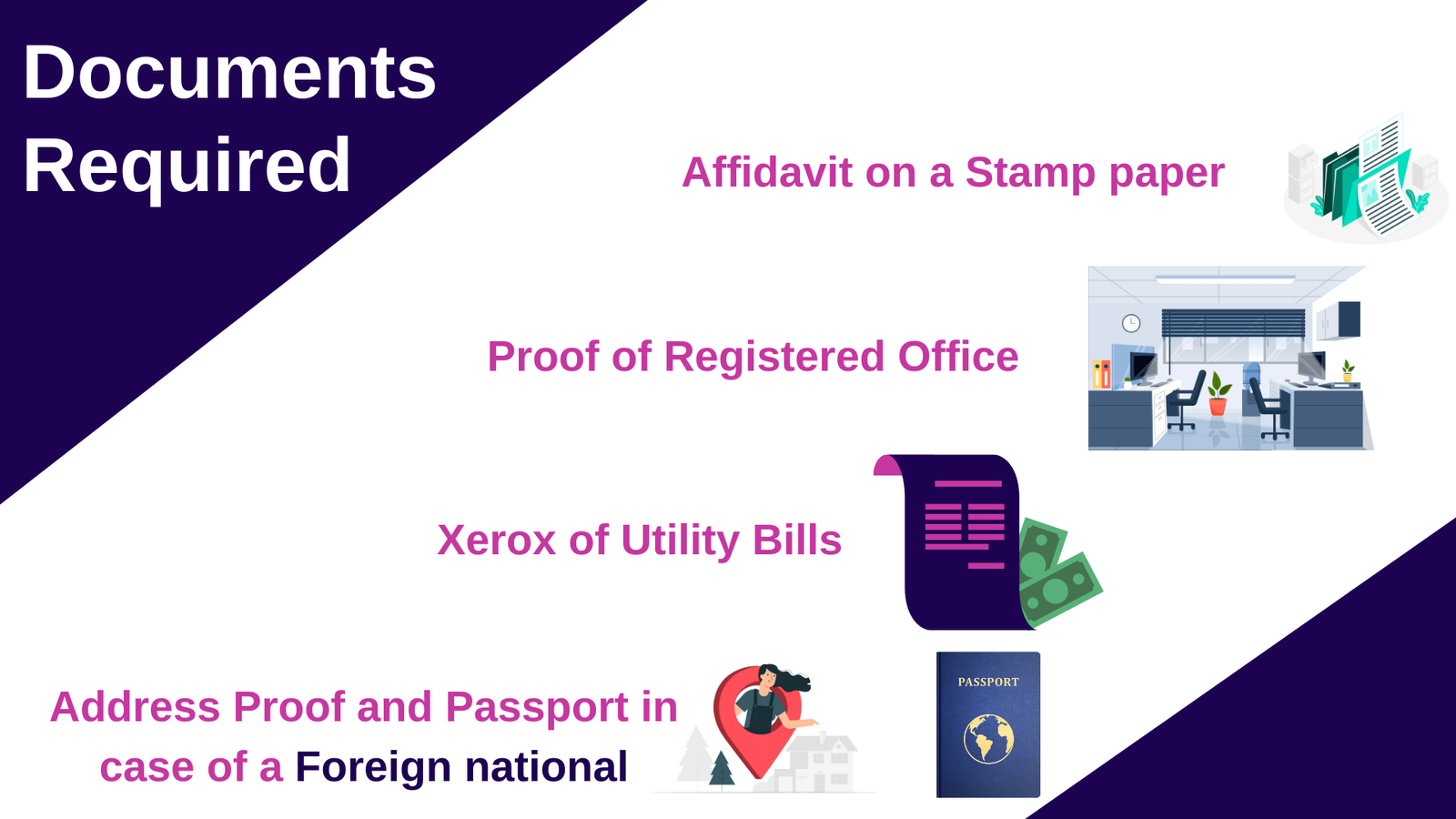

DOCUMENTS REQUIRED

The following documents are required for conversion:

- PAN Card copy of all directors (Identity Proof).

- Copy of Aadhar card/ Voters ID (Address Proof).

- Passport size photographs of Directors.

- Proof of ownership of business place (if owned).

- Rental agreement if rented.

- No Objection Certificate (NOC) of Landlord.

- Electricity or water bill.

The forms to be submitted to the MCA are: – Form 1 must be filed with the MOA, AOA and other documents. – Form 18 specifies the details of the registered office. – Form 32 details the information of the directors.

Users This Year : 10440

Users This Year : 10440