TRUST DEED

Why Choose Dastawezz ?

INTRODUCTION

A trust is a form of arrangement in which the asset is transferred by the owner called the settlor/ author to another person called the trustee for the benefit of a third class of persons known as beneficiaries. The interested parties must register a trust deed to transform the Trust into a legal entity. These agreements clarify the scope of authority to the trustee who manages the assets of the settlor. Trusts in India are governed and registered according to the provisions of the Indian Trusts Act, 1882.

PROCESS

- Firstly, choose an Appropriate Name for the Trust. The chosen name must not come under the restricted list of the Emblems and Names Act, 1950. The Settlers or Authors and Trustees of the Trust must also be decided at this stage.

- Usually the number of authors/settlers is one, however there is no provision mentioning the number of authors. There is no limit on the maximum number of trustees, but a minimum of two trustees are necessary to form a Trust. Further, the author generally cannot be the trustee and he/she needs to be a resident of India.

- One must Formulate Memorandum of Association (MOA) and Trust Deed of their Trust. Memorandum of Association (MOA) represents the charter containing the objectives of the Trust and also defines the relationship of the Trustor with the Trustees. It should contain the names, addresses and occupations of all the members along with their signatures.

- The Trust Deed is legal proof of the Trust’s existence and it contains the rules and regulations and bylaws of the trust including provisions for the changes, removal or addition of the Trustees.

- Further the trust deed must be prepared on a stamp paper. The value of this stamp paper is a certain percentage of the total value of the Trust’s property. This percentage varies from state to state according to their laws.

- Additionally one needs to pay a fee of Rs. 1100, out of which Rs. 100 is the registration fee and Rs. 1000 are the charges of keeping a copy of the Trust Deed with a sub – registrar. Upon successful submission of all documents and papers, one can collect a certified copy of the Trust Deed within one week’s time from the registrar’s office.

- Upon receiving a certified copy of the Trust Deed one must submit it along with properly attested photocopies with the local registrar. The settler must put his signatures on every page of the photocopy of the Trust Deed and the settlers along with two other witnesses must mandatorily be physically present along with their identity proof (original as well as self attested photocopy) at the time of registration. However, physical presence of Trustees is not mandatory.

- After submitting the Trust Deed with the registrar, the registrar retains the photocopy and returns the original registered copy of the Trust Deed. Upon successfully completing all the formalities, registration certificate is issued within a minimum of seven working days.

ADVANTAGES / FEATURES

- Long term taxation benefits and statutory rights.

- Fewer audits, ensuring seamless charitable activities.

- Provides a legal roadmap for the charitable entities and is beneficial to the heirs and successors.

- It is autonomous and has actual control over it’s activities.

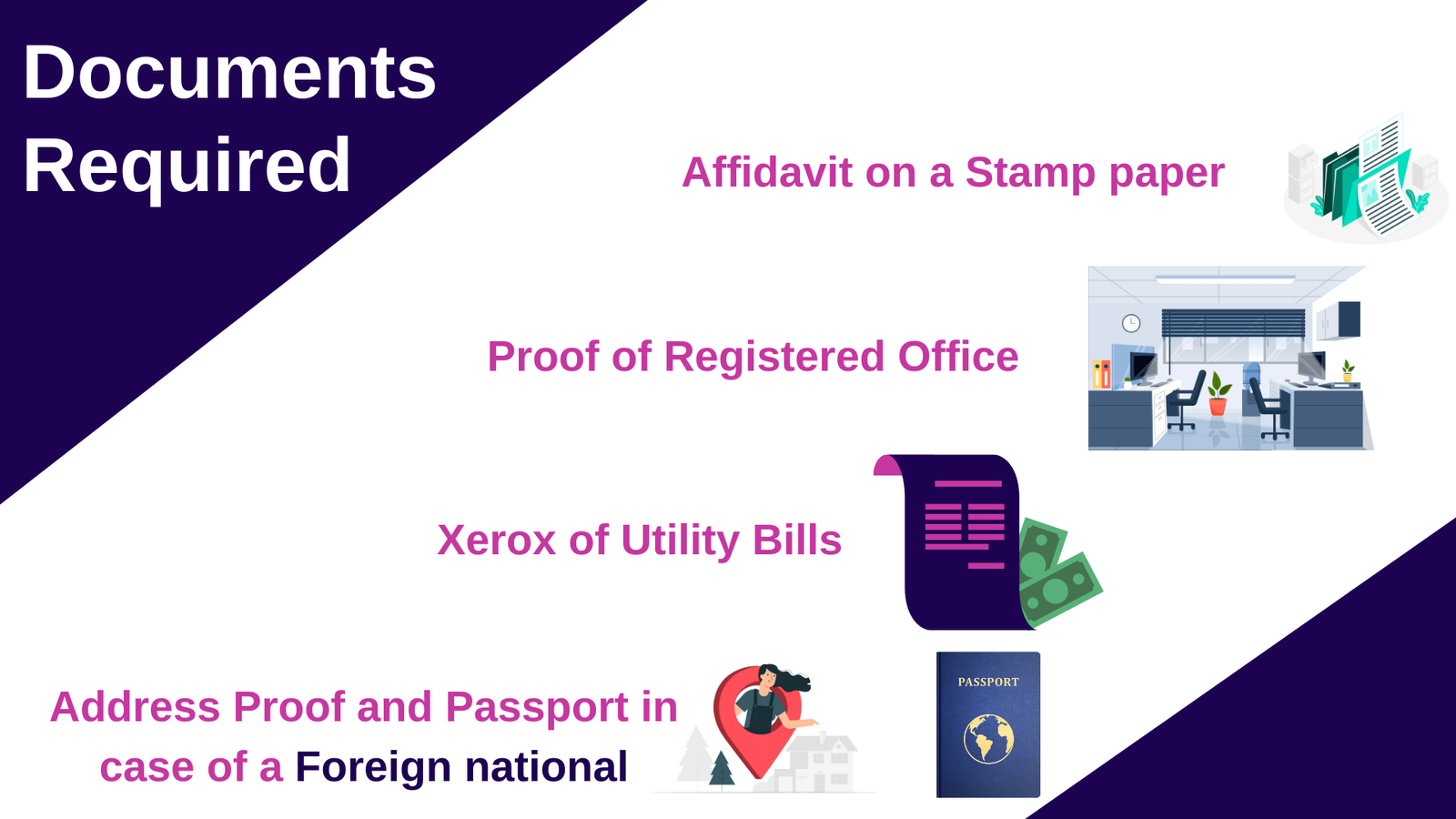

DOCUMENTS REQUIRED

- Trust Deed on proper stamp value

- Self attested copy of the proof of identity of the settler/author and each trustee (Aadhaar card, passport, voter ID, driving license or any such photo ID)

- PAN card

- Proof of the registered office address of the Trust (electricity/water bill or registration certificate)

- Non-Objection letter signed by the landowner

Users This Year : 16395

Users This Year : 16395