START-UP INDIA SEED FUND SCHEME: A SOLACE FOR THE START-UPS.

Introduction

The SISFS (Startup India Seed Fund Scheme) is one of several government initiatives targeted at supporting the startup business. For example, in February 2021, the Small Industries Development Bank of India (“SIDBI”) and Social Alpha announced the establishment of the “Swavalamban Divyangjan Assistive Tech Market Access fund,” which will award financial grants to assistive technology firms fostered by SIDBI. Similarly, the previous union budget extended till March 31, 2022 the deadline for startups to apply for a tax exemption under Section 80-IAC of the Income Tax Act of 1961.

For a startup to be eligible for the SISFS, the following criteria must be met:

- It must be recognized by the Department for Promotion of Industry and Internal Trade (DPIIT) and must not have been in operation for more than two years at the time of application. Furthermore, Indian promoters must own at least 51 percent of the company.

- It should have a business plan in place to produce a service or product that has the potential for scaling, market fit, and profitable commercialization.

- Startups that use technology in their main service or product, as well as their distribution and business plan, are also eligible.

- Startups that have not received financial help in excess of INR ten lakhs from any other government program/scheme are eligible.

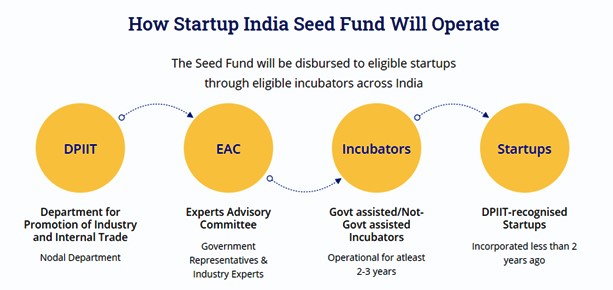

If the aforementioned prerequisites are met, the authorized incubator will distribute the Seed Fund under the SISFS as follows:

- A financial grant of up to INR Twenty Lakhs is available for prototype development, product trials, or Proof of Concept validation. The grant will be given in instalments dependent on achievement of certain criteria. Such milestones can include, among other things, product testing, prototype creation, and preparing a product for introduction in the relevant market.

- Up to INR Fifty Lakhs in financial awards can be awarded to a company through convertible debentures, debt-linked securities, or debt for market entry, commercialization, or scaling up.

Problems associated with the SISFS

The SISFS Seed Fund is more likely to assist entrepreneurs in fields that have received less venture financing, such as education, e-commerce, tourism, and food technology. It is part of the government’s mission to not only promote current and future generations of entrepreneurs, but also to create a strong startup ecosystem that will generate jobs, especially in smaller and rural locations.

The programme would promote virtual incubation for businesses by developing an online infrastructure. This might broaden the scheme’s scope, allowing it to address the current pandemic issues. Simultaneously, the bureaucratic processes and stringent qualifying conditions of the scheme can make its execution difficult.

The fundamental issue with SISFS is that several features of the scheme’s implementation are ambiguous. For example, one of the startup eligibility requirements is that the “company must have a business idea to build a product or service with market fit, viable commercialization, and scope of scaling.”

The SISFS, on the other hand, makes no distinction between what defines “market fit” and “viable commercialization.” This could lead to a broader issue with the SISFS, in which the incubators and EAC have been given enormous discretionary power in selecting ‘suitable’ companies and incubators, respectively.

Similarly, the EAC has the authority to define the milestone levels for monitoring progress at its sole discretion. As a result, if the milestones are set too high, meeting the SISFS targets will be nearly impossible. Subsequent payments of funds to incubators and, eventually, Startups would come to a halt.

To summarize, the SISFS plan is now being welcomed by the startup industry and the media, but its successful implementation will be entirely dependent on the EAC, entrepreneurs, and incubators working in tandem, which remains to be seen.

Extending the scope of Section 233 to Startups

The Ministry of Corporate Affairs expanded the scope of Section 233 of the Companies Act, 2013 read with Rule 25 of the Companies (Compromises, Arrangements, and Amalgamations) Rules, 2016 to include a merger between a startup and another startup or a startup and a small company on February 1, 2021, via a gazette notification.

Section 233 deals with company fast track mergers. A fast-track merger, as the name implies, is a faster process that removes many phases in a regular merger. In this form of merger, the courts have no role to play, and the parties are not required to seek clearance from the NCLT.

The Ministry of Corporate Affairs expanded the scope of Section 233 of the Companies Act, 2013 in a gazette notification on February 1, 2021. Startups are now recognized corporations under Section 233 of the Companies Act, 2013 and Rule 25 of the Companies (Compromises, Arrangements, and Amalgamations) Rules, 2016 for the purpose of merging with the Central Government’s sanction.

This form of unique merger could decide the rate of economic recovery after the pandemic, given that the NLCT would be inundated with IBC cases, and could be particularly effective due to the benefits of ease of doing, money involved, and time invested with Rule 25 of Companies.

Advantages of Fastrack Merger

- It is not required to request permission from the National Company Law Tribunal.

- It is also not necessary to issue public advertisements.

- The meeting has not been called by the court.

- The administrative burden has been reduced.

- The same effect as dissolution, but without the transferor corporation’s winding up process.

- These types of mergers are both cost-effective and time-efficient.

SEBI Saving the start-up trading platform

There were numerous hurdles encountered by small businesses and startups were directly related to their description; not every company has the resources of a huge organization, especially a startup whose goal is innovation.

To be designated a startup for the purposes of a fast-track merger, a firm must meet all of the standards outlined in the Department for Promotion of Industry and Internal Trade’s notification of February 19th, 2019.The rigorous approach was proving to be a barrier for both start-ups and firms with low revenue/turnover. The same approach for each organization, regardless of size, was showing its age, especially during the pandemic, when businesses struggled.

The start-up culture in India is young and thriving, as evidenced by the fact that 14 of the country’s start-ups have reached Unicorn status, i.e., $1 billion in value, in just 7 months since the pandemic hit the Indian economy in 2021.

SEBI developed the Innovators Growth Platform (previously Called Institutional Trading Platform) in 2015 to list these start-ups, get visibility, and expand the brand presence of these start-ups in order to nurture them. SEBI’s objective was to create a trading platform specifically for start-ups, similar to the NASDAQ stock exchange.

While the Platform hasn’t experienced much success since its establishment, as no entity is currently registered on the IGP, SEBI hasn’t given up hope, as SEBI sought amendments to the IGP at the board meeting on March 25, 2021, which were informed on May 5, 2021 via two different notifications.

The rationale for SEBI’s active nature here is to access resources, i.e., potential investors eager to engage in a startup because it is an under-invested field. Only 9% (3436 out of 38,815) of active start-ups were able to raise additional funds after initial investment rounds.

Conclusion

The concept of mergers and acquisitions scares startups owing to the costly and time-consuming nature of the process, and a requirement of public offer notification for a mere 25 percent of shares ensured less interest; however, under the revised laws, it has now been boosted to 49 percent. To further safeguard interests, any change in control, whether direct or indirect, will henceforth result in an open offer.

SEBI has also simplified the delisting and migration process to the mainboard. A statement of explanation must be given to shareholders, and they must pass the exit by special resolution; it must also be passed by the Board of Directors at its meeting.

The goal of India becoming a hub for software start-ups seemed far-fetched a few years ago, but the success of numerous start-ups in becoming unicorns has increased trust in the Indian startup sector. The new restrictions are intended to enhance the government’s ease of doing business policy.

References

- Ministry of Commerce & Industry, ‘Prarambh: Startup India International Summit’, (15 JAN 2021 3:44PM by PIB Delhi), https://pib.gov.in/PressReleasePage.aspx?PRID=1688799.

- The Gazette of India, ‘Ministry of Corporate Affairs’, (1 FEB 2021 New Delhi), https://egazette.nic.in/WriteReadData/2021/224868.pdf

- 3. https://www.unicefinnovationfund.org/apply/unicef-innovation-fund-opportunity-tech-startups

Users This Year : 4017

Users This Year : 4017

Leave a Reply

Want to join the discussion?Feel free to contribute!