WHY INTERNATIONAL INVESTORS AND VENTURE CAPITALIST INVEST IN INDIAN START-UPS : DETAIL INFORMATION

Introduction:

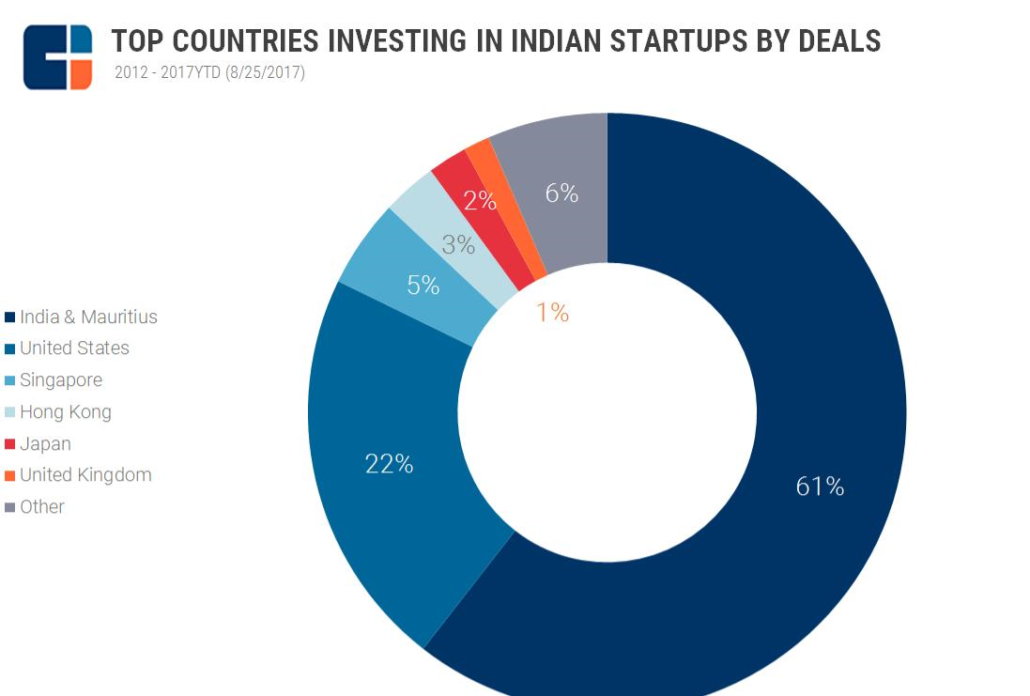

Have you ever considered the reason of start-ups failure, why the founders of these small businesses couldn’t make it like other thriving businesses, which were at one point of time started with scratch but now they are standing proudly in the market. We ask these questions frequently. In 2014, a study done by Fortune.com, it found that out of ten start-ups nine fail, and they are unable to bring their board to the real world. This study also reveals that shortage of funds is the main reason for failure of 30% start-ups and another reason is not enough market demand. So, it is necessary for a start-up that before implementing any business plan or process, it has enough capital for its success. But the situation is changing, because of the success and hard work of many Indian Start-ups, their new ideas, in the last decade and its prosperous environment; they are gaining the attention of foreign countries. Foreign Direct Investment is growing in India and it continues to grow and the result is that the majority of the stakes in Indian start-ups are held by foreign stakes. Because of the innovative ideas of India start-ups, foreign investors believe in their idea and supply the necessary capital required for the growth.

Meaning:

To allow the flow of foreign investment in India Start-ups, the Government of India made provisions in the consolidated FDI policy 2017, which made possible for the Foreign Venture Capital Investors to subscribe up to 100% of the capital of Start-ups, under the automatic route. It allows them to invest in equities or equity-linked or other debt instruments issued by the start-ups and if the start-ups are Partnership or LLP, they can invest in capital or profit sharing. Before moving forward, for better understanding it is necessary to understand some terms like what is start-up, what do we understand by Venture Capital and Foreign Venture Capital Investors?

- What is a Start-up: As its name suggests start, the term simply means the starting of a business venture; it refers to a company which is in its initial stages of operations. These start-ups are founded by one or more entrepreneurs, who have studied the market, its needs and on the basis of that study they develop that product or service which is in demand. These entrepreneurs in the earlier stages of the company invest themselves but due to the schemes of the Government like Start-up India, to promote the idea of start-up they have been given certain benefits like tax exemption, rebate in patent application and investment through alternative investment funds etc.

- Meaning of Venture Capital: When start-ups require initial capital or seed capital, then Venture capital plays an important role, this type of funding is different from other conventional sources as Venture capitalist funds those small businesses that have innovative ideas and their ideas have potential for growth in the competitive market. Venture capital funds give risk capital to such businesses, as they know these start-ups have high risk exposure but there is a chance of growth and profit, so in simple words Venture capital is a high risk and high return investment. They don’t provide loans but in exchange of provided capital, equity stake or ownership in the business is offered.

- Who are Venture Capitalists?: They are limited partnerships who have pooled investment capital, and they invest that capital in a number of companies. They are different in size; they can be a small group of investors or subsidiaries of a large investment bank, commercial bank or may be outside investors. These Venture Capitalists have enough experience and they utilize their expertise to finance those companies who have potential to bring in considerable return on the Venture Capitalist’s investment.

- Definition of Foreign Venture Capital Investor (FVCI): The term “Foreign Venture Capital Investor” investment by a non-resident or a foreign investor. They invest in Indian Venture Capital Undertakings (IVCU) or Venture Capital Funds. The term has been defined in both SEBI’s FVCI regulations (Regulation 2(g)) and Foreign Direct Investment Policy, 2020, both the definitions are same, which says that the foreign country which invests in India’s Venture Capital is known as Foreign Venture Capital Investor and there are three conditions which must be satisfied by them, 1. Must be incorporated outside India. 2. Must be registered with SEBI, 3. Must follow SEBI’s FVCI Regulations.

FVCI Regulations in India:

- Eligibility Criteria to get FVCI Certificate from SEBI: According to the regulations 4 of the FVCI regulations, a foreign investor or an applicant has to conform to certain conditions, which are given below:

- The track record of the applicant person or company; Professional skill or knowledge;

- Applicant should be financial sound in order to apply for certificate;

- Must work with integrity and fairness;

- Mention if applicant is governed by an appropriate foreign regulatory authority or is an income tax payer or present a certificate from its banker or its promoter’s track record, where applicant is neither a taxpayer or a regulated entity;

- According to the Schedule 2 of the SEBI (Intermediaries) Regulations, 2008, the applicant must be a “fit and proper person, and there are many other important conditions

If the above mentioned conditions are fulfilled then the board will grant a certificate of registration as FVCI to the applicant, if the application is incomplete or necessary conditions have not been met then after giving some time to get rid of objections or an opportunity of being heard, the application will be rejected by the board.

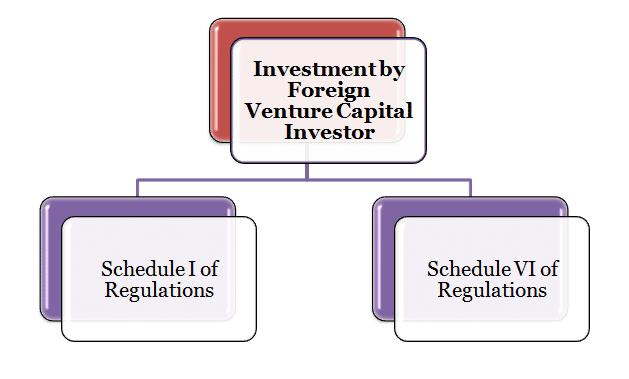

- Types of Investment Made by an FVCI: In India FVCI can enter in to 2 types of Investment:

- Indian Venture Capital Undertaking: These are newly incorporated private companies which are so new that they are not completely established in market, they are in need of finances and advice from the investors:

- Venture Capital Fund: It is a fund, as its name suggest set up as a trust or a company:

- Restrictions on Investments: According to the Rule 11 of the FVCI regulations, the investment must be made in the given manner:

- It is mandatory that a minimum percentage of funds to be invested must be invested in the unlisted equity shares or equity-linked instrument of a VCU and the minimum percentage is 66.67;

- The other condition is not mandatory, it says that the remaining portion of the investible funds can be invested in the IPO of a VCU, Debt or debt instrument of a VCU, Preferential allotment of equity shares but there is condition of 1 year lock-in period, etc.

It must be kept in mind that whatever the investment strategy chosen by the Foreign Venture Capital Investor and its life cycle must be communicated to the board before any investment is made in India.

Need of FVCI: India has tremendous potential for growth of knowledge based industry, and this potential is not limited to one sector of economy, some relevant areas are bio-technology, pharmaceuticals and drugs, telecommunication, education, food, agriculture, services etc. Due to the innovative ideas of many entrepreneurs, we can say India has inherent strength which reflects in its skilled and competitive manpower, its technology, research based skills, studying the market and all we need a proper environment investment and policy support, with this India can achieve growth and competitive global strength. There is huge gap between the capital requirements of technology and knowledge based start-ups and funding or investments available from conventional banks, reason being is that these business are new and there is high risk exposure, they are based on intangible assets such as human capital and Indian investors don’t want to lose their funds, from the point of view of the traditional banks, neither they have physical assets nor a low-risk business plan so we need a flourishing venture capital industry which can fill this gap.

Benefits of Investment in Start-ups to Foreigners:

- Foreign investors are exempted from any pricing restrictions during entry and exit;

- When the investee company goes public, the foreign investors are exempted from the condition of lock-in period;

- Advantage of Population: India has a huge population, that means variety of taste and preferences, which is helpful for the start-ups to come up with new innovative ideas according to the demand of the people and it is less problematic to start a business in such a market and which promises to be a magnet for foreigners.

- More control on Start-ups: The reason being is that foreign investment acts as an easy capital raise and technological investment for the start-ups, that’s why Indian Start-ups easily accept them. Due to the need of the capital, sometimes start-ups give away huge stakes in the company, which proved beneficial for the foreign investors. It gives them important decision making power, critical rights, return on the investment, control on the consumer market of the country.

- Efficient Tax System: With respect to the tax on venture capital we must adhere to two sections, one is sec 10(23FB) of Income Tax Act, 1961, which says that when income of a person in a previous year is calculated, any kind of income of a venture capital fund or company in a VCU shall not be included, another section is sec 115(U), which says that if a person receive any income from the investment made in venture capital fund or company then such income shall be charged to income tax in the same method as if it were the income which received by the person had he made investment directly in the venture capital.

When these two sections are read together, they give the meaning that income received from investment by the fund or company is exempted from tax, but when the income is dispersed between the investors, it becomes taxable. In simple terms, income’s nature determines its tax liability. It says that dividend is free, when it is in the hands of the shareholders but it is subject to tax at the rate of 16.99% when a company is distributing the dividend. Otherwise, when shares of the investee company are sold, capital gain tax is also charged. The result is that there is no distinct tax exemption for FVCI. But it can take benefit of DTAA agreement like India has a agreement with Mauritius, and according to the article 13 of that treaty, when a resident of Mauritius make a transfer for Indian capital asset, any benefit from such transfer will be taxable only in Mauritius, this treaty give relief from double taxation.

- Reduced Operational cost: The cost of internet, labour, salaries, infrastructure, etc is very low in India and India has very moderate tax policies as compared to the other countries which results in low cost of business operations. And it is one of the reasons why foreign investors invest in India.

- Friendly Laws: The bill of Goods and Service Tax has made the cross border movement of products and some other business friendly law like Direct Tax Code Bill, Land Acquisition Bill, Companies Bill etc these made easy for the foreign investors to enter Indian market.

- Initiatives of Government: 1. In December, 2020, the guidelines for Direct-to Home (DTH) services have been amended with the approval of Union Cabinet, because of these changes, 100% FDI in the DTH broadcasting services market is made possible;

- In June, 2021, the G-7 countries has attained a contract on taxing multinational firms, it says that the minimum global tax would be at least 15%, this move was made to boost the foreign direct investment in the country.

- In September, 2021, India and UK agreed to boost investment; this step will strengthen the bilateral ties for “Enhanced Trade Partnership”.

Conclusion:

In the recent years, there has been an extraordinary growth in the foreign investment of India at a massive rate. India has come out as the fastest-growing start-up eco system and the third largest in USD 81.7 billion foreign investment in the financial year 2020-21. According to the World Bank of Ease of Doing Business 2020 survey, India has jumped 14 ranks and now its position is 63rd across the globe. All this could happen due to the foreign policies made by the India to attract the foreign companies and foreign investors and which resulted in growth of the Indian Start-ups, more job opportunities and wealth creation of the Indian economy.

But the investment by foreign investors is a double edged sword; foreign investment in the start-ups is also termed as “easy capital”, but it comes with a cost, there is always a catch. As India entrepreneur makes their business model which are attractive to foreign investors, this may result in giving more stake in the ownership, more critical rights in their businesses, taking troublesome obligations etc. Due to these control deals foreign investors get the full power to, monitor and manage portfolios of the companies, more control in decision making, implementing strategies which are foreign investors friendly. As investors’ main goal is to expand, so they have a opportunity to exit with a handsome gain, they don’t invest for a long period, so Indian promoters must be conscious of these factors before making foreign control deals.

References

- https://www.letscomply.com/foreign-investment-in-indian-start-up-and-its-advantages/

- https://www.investopedia.com/terms/s/start-up.asp

- https://www.ahlawatassociates.com/blog/a-primer-on-foreign-venture-capital-investments-in-india/

- https://www.fdi.finance/blog/foreign-investment-in-indian-start-ups/

- https://smefutures.com/key-promoter-considerations-foreign-investment-in-indian-start-ups/

Users This Year : 10565

Users This Year : 10565

Leave a Reply

Want to join the discussion?Feel free to contribute!