PRODUCTIVITY, INVESTMENT AND INFRASTRUCTURE: CORE OF UNION BUDGET (FY 2022-23)

Introduction

As we all know Covid has created a lot of uncertainty in India, like losses of jobs, health risk, etc, and this year’s budget has proven a ray of hope amid the dark clouds of Covid. This year’s budget has focused on four pillars, productivity, financing investments, climate action, and PM Gati Shakti Plan.

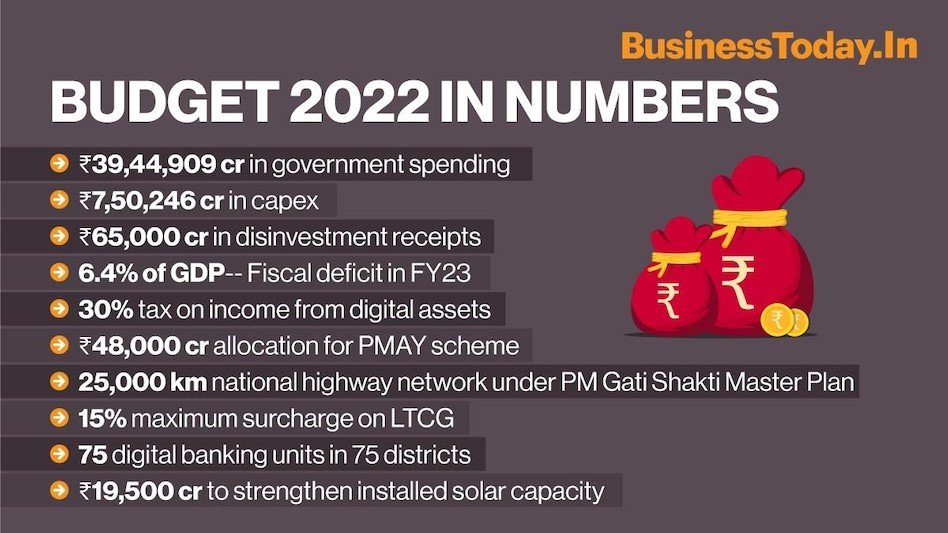

Yes, by looking at the data we can see that the fiscal deficit is higher that is 6.9% for 2021-2022 and 6.4% for 2022-2023, and capital expenditure has increased by 35%, but instead of grieving on the increasing deficit, it is necessary that more efforts are being put on digitalization of education, currency, passports, growth of start-ups and small businesses, infrastructure, etc. Can we say that this budget will be ideal, no nothing can be ideal, because the budget for the year 2019-20 has also been made for increasing the growth and economy of the country, but then we got hit by Covid, which was not expected by anyone, so no we can’t say this year or the coming year’s budget will go as planned, as we can say what will happen in future, all we can do is to make efforts and by looking at some highlights given below, we can see that Government is doing a good job at making efforts.

Highlights for Start-ups, Small businesses, and Manufacturing Companies

- India will not ban digital assets; last year it was in reports that Govt could ban all forms of Cryptocurrency, NFT, non-refundable tokens, assets like bitcoin or Ethereum. India doesn’t have a law to regulate them yet, Digital Assets will be taxed at the rate of 30%. Any income from the transfer of any virtual digital asset shall be taxed at the rate of 30%. If you make profits by investing in crypto or if you transfer these assets to another person you will pay a tax of 30%. Any loss incurred from such transfers cannot be set off against any other income or carried forward to subsequent years. This move of the government will be good and will be bad, good that these assets will not be banned and bad for investors that they will pay 30% tax. A gift of virtual digital assets is also taxable and from the 1st July 2022, on payment of consideration to a resident when the transfer is made for the virtual digital asset, this transfer will be subject to 1% TDS.

- India is getting its Digital currency; the Reserve Bank of India will issue it in the new financial year that is 2022 to 2023. Introduction of Central Bank Digital Currency will give a boost to the digital economy. It will lead to a more efficient and cheaper currency management system.

- No change in Income tax rates. You will be paying the same income tax as last year. A small change brought is how you file those tax returns, you can now file the updated return within 2 years of the assessment year, but they will have to pay a 25% penalty on tax and interest due if it is filed in the year after the assessment year, and a 50% penalty in the second year.

- Tax Incentive to start-ups extended for a year, it is said by Finance Minister that Start-ups have emerged as drivers of growth for the economy. The budget has announced that eligible start-ups established before 31st March 2023 will be given tax incentives for three consecutive years out of 10 years from incorporation, earlier a three-year tax incentive was available to the start-ups established before 21st March 2021. It is said that the extension of tax benefits will further strengthen the business ecosystem of the country.

- This year’s budget has also extended the last date or period of starting of manufacturing and production by eligible new manufacturing domestic companies, to 31st March 2024, earlier the date was 31st March 2023, this will give them another year to have an option to pay tax at 15% (without claiming any deductions).

- Room for Startup India Seed Fund Scheme in Budget, The government has allotted Rs 283.5 crore for the Startup India Seed Fund Scheme in the Budget 2022-23, which is greater than the Revised Estimate of about Rs 100 crore. The government has set up a Fund of Funds for Startups (FFS) with a corpus of Rs 10,000 crore. The budgetary allocations for the Fund of Funds for Startups stood at Rs 1,000 crore. The Small Industries Development Bank of India (SIDBI) is the operating agency for the FFS. According to the Budget documents, the allocation for the Startup India program has been increased to Rs 50 crore for 2022-23 from the Revised Estimate of Rs 32.83 crore in 2021-22.

- Push for Promotion of drones through start-ups, in the Budget 2022, Finance Minister announced that with the help of start-ups several steps will be taken to promote the drones, the mission is called ‘Drone Shakti’ using different applications and Drone-as-a-Service (DrAAS) and this mission’s goal is to make India a drone hub by 2030. There is something called Kisan Drones, they will be encouraged for crop assessment, spraying of insecticides and nutrients on fields, and land records will be put into digital records that is the digitization of land records. And there will be a requirement of skill for using these drones, and for this, courses on drone skills will be given in selected Industrial Training Institutes in various states. For providing digital and hi-tech services to farmers, a scheme will be launched through the Public-Private Partnership mode.

- The Emergency credit line for MSME has been extended till March 2023, in total 5 lakh crore is available for such firms. The emergency Credit Line Guarantee Scheme had earlier provided additional credit to more than 130 lakh MSMEs. The Govt has extended the scheme by 50,000 crores and now this scheme will provide a total cover of 5 lakh crore. Centre said that Credit Guarantee Fund Trust will be improved by infusion of funds for MSMEs; this will provide additional credit of 2 lakh crore and will result in more job opportunities.

- Major connectivity push, India wants to spend big on infrastructure, 20,000 crore rupees, it is Prime Minister’s Gati Shakti Plan, to facilitate faster transfer of goods, speed up cargo movement and to improve logistics network. This money will be spent on roads, railways, airports, ports, mass transport, waterways, and logistics infrastructure. The biggest spending will be on national highways. In the next 3 years, India wants to build 400 new trains and 100 carbo terminals. India plans to spend a whopping 100 billion dollars on infrastructure and it is 35% more than 2021 and double what India had spent before the pandemic. And this a direct spending, it means govt will foot the bill for all these projects.

- Boost for Make In India in Defence, there is a marginal increase in the defense budget, the allocation this year is 5.25 lakh crore rupees, which is more than 60 billion dollars, which is an increase of almost 5% from last year. The bulk of the budget will go to Indian Manufacturers, 68% of the procurement will happen from domestic players, 25% has been set aside for research and development.

- Up-gradation of Indian Passports, Starting this year, Indians will be issued E-passports. There was the first announcement in 2019. So far the 20,000 officials and diplomats have been issued e-passports and now we will be able to get one. How will this passport be different? These passports come with a chip, a small silicon chip embedded on the back of the passports and this chip will contain all the necessary information, like your name, address, passport number, and data of your last 30 visits. More than 100 countries have such passports.

- Upgrading India’s Mobile Network, 5G is coming in 2023. Spectrum will be auctioned this year. India also wants to become a hub for 5G manufacturing. Incentives have been announced for equipment makers and there is also a proposal to bring internet to Indian villages. The Govt. is also going to award contracts to lay optical fiber cables around the country.

- Digital Education, this topic is getting a major push in this budget. India plans to develop a Digital University, the Finance Minister said it will provide students with world-class education. There is another proposal called E-Vidya, under this, the Govt of India had earlier set up 12 TV channels to teach students and now this will be expanded to 200 channels. The idea is to provide supplementary education in different regional languages.

Conclusion

As from the above-mentioned highlights from the Union Budget, you can see that from the first two points that even though there is no law to regularize digital assets, efforts have been made to legalize them in India and soon India will issue its digital currency, digital university, E-Vidya, another year given to start-ups and new manufacturing companies for tax incentive all these shows signs of growth and skill enhancements.

Some people will argue that no direct relief has been given to the salaried and middle-class people in the form of tax so that they can survive inflation, the impact of Covid on income and jobs, our finance minister well said in this aspect that “There are times when you can give relief and there are times when you have to wait a big longer”. There will be many people in the country who will criticize these points in the budget, but they should remember that we are a developing country and all the sectors are like bars in the bar graph, some bars will go up and some bars will look the same as earlier, but it doesn’t mean the growth is stagnant. For the year 2022, India’s GDP is projected at 9.2 percent, if all pieces fall in the expected places, then I think India can achieve its goal.

References

https://blog.forumias.com/push-for-promotion-of-drones-through-start-ups/

Users This Year : 10564

Users This Year : 10564

Leave a Reply

Want to join the discussion?Feel free to contribute!