Gift Deed

Why Choose Dastawezz ?

INTRODUCTION

There are multiple types of transfers, among which, there is transfer by way of gift. Such transfer usually is a consequence of love and affection. As the nomenclature may suggest, a transfer by way of gift is one in which there is no consideration. The benefit is unilateral which flows from the transferor to the transfree, or donor to donee. It is crucial and mandatory to get the deed of such transfers registered.

PROCESS

1. Drafting the deed: the deed should include the following:

- Identification of parties

- Place, Date and Time of execution of the deed

- Details of both the parties, like addresses, relationship, date of birth

- Identification and details of property

2. Circle Rate and Consideration: Though the transfer is via gift and there is no involvement of consideration, still it is essential to determine the value of the property in order to estimate stamp duty and registration charges. Such value calculated on the basis of the estimated area of the property and the market rate/circle rate per sq. ft..

3. Stamp Duty: The stamp duty is a cost paid to the government, which is on percentage basis, determined by circle rate or actual value of property. Such duty differs from state to state and also varies based on the type of property. It can range between 3% to 10%. For instance, the stamp duty rate in Delhi is 6% for men, 4% for women and 5% in case of joint ownership.

4. Registration Charges: Along with the stamp duty, a 1% overhead registration cost also needs to be paid.

5. Payment of Charges: The stamp duty and registration charges can be paid online and citizens residing in Delhi, Gujarat, Chhattisgarh, Karnataka, Himachal Pradesh, Odisha, Tripura, Ladakh, Chandigarh, and Jammu & Kashmir can avail e-stamping facilities. This can be done by visiting https://www.shcilestamp.com/, which is the website for Stock Holding Corporation of India. On the alternative, this can also be done by purchasing non-judicial stamp paper from authorized Stamp Vendors.

6. Sub-Registrar’s office: Visit the sub-registrar’s office, having jurisdiction over the area in which the property is located, after taking appointment. This visit entails the last and final step of registration of Gift Deed, which would conclude the transfer process. The donor, the donee, along with two witnesses have to sign and authenticate the deed.

7. Collection of Registered Gift Deed: Upon successful completion of above formalities, the sub-registrar’s office would provide you with a token slip, which has to be presented after 15-20 days, to collect the original registered Gift deed.

ADVANTAGES / FEATURES

- It is a compulsory process

- It establishes a strong and undeniable proof of transfer, which helps in contesting against any claim made owing to succession or any other reason

- It is necessary to register a sale deed and formalize the process because the property is attached with certain costs and liabilities, like property tax, municipal bills. Therefor, the assent and acceptance of the donee with respect to such liabilities is necessary.

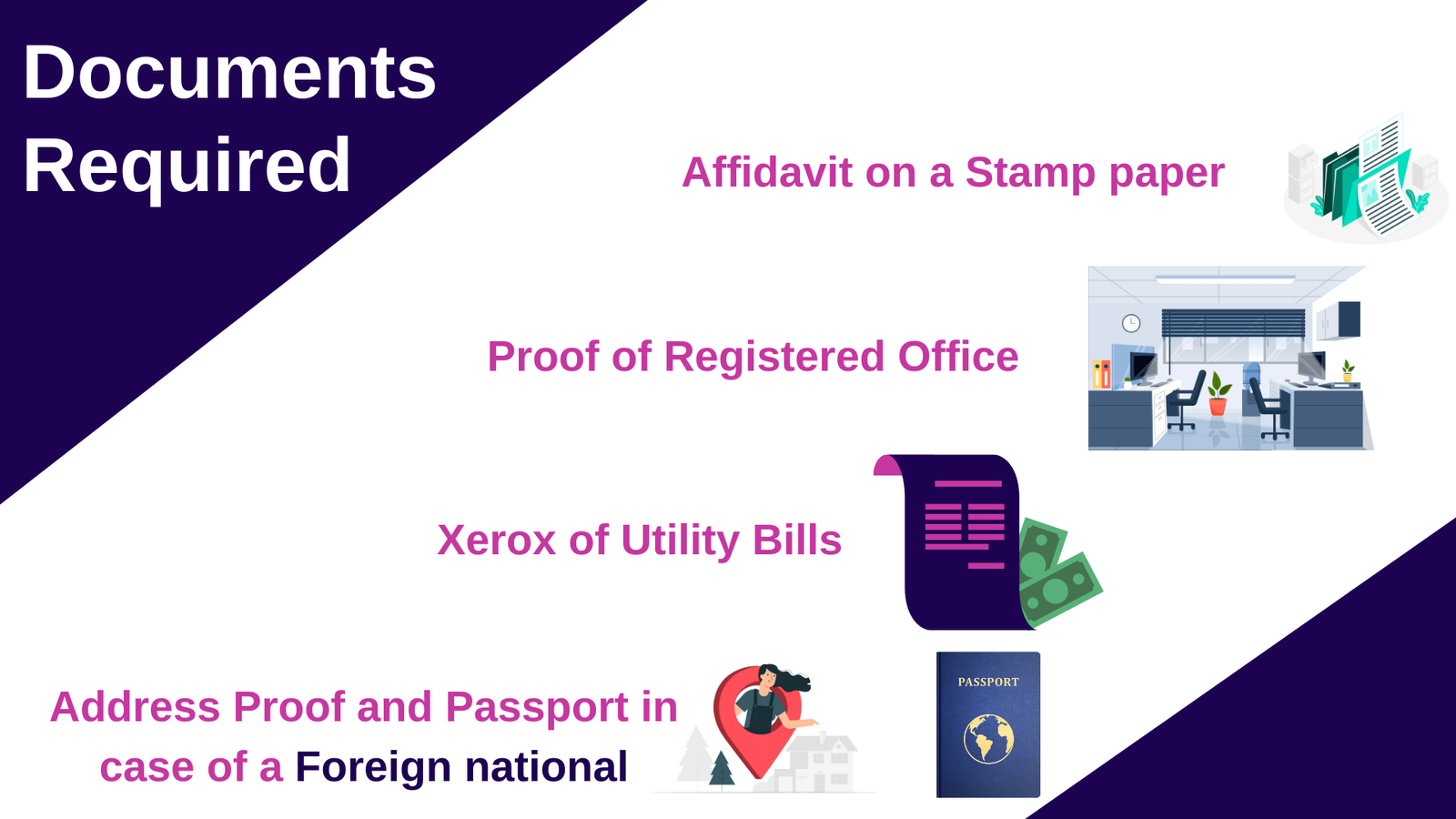

DOCUMENTS REQUIRED

- Duplicate copies of the unregistered Gift Deed

- Two passport size photographs of the buyer and seller

- ID proof

- Certified true copies of incorporation in case of a company

- Copy of Municipal Tax Bill

- PAN Card

- Stamp Paper or e-stamp paper and registration fee receipt

Users This Year : 10576

Users This Year : 10576